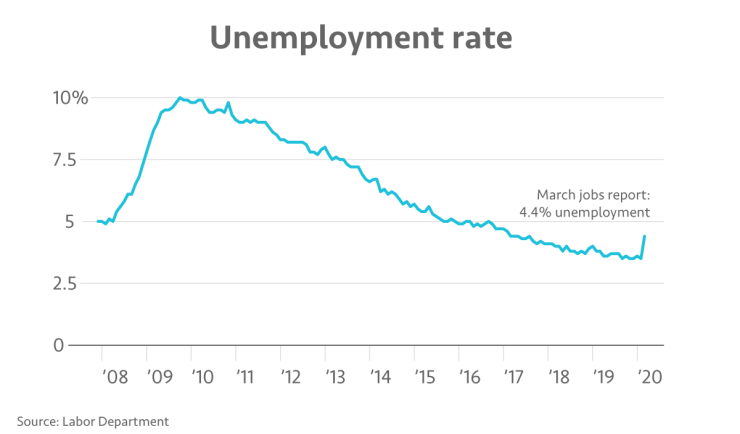

The Labor Department’s March jobs report reveals that the U.S. unemployment rate rose to 4.4% and the economy lost 701,000 jobs, breaking a more than 9-year streak of job gains.

Here’s a look at how employment has changed since the start of the Great Recession:

In the prior 12 months, non-farm employment growth had averaged 196,000 per month, according to the report.

While the monthly jobs report is typically a good indication of how the economy is doing, these latest numbers don’t even capture the full scope of the economic damage caused by the COVID-19 pandemic. That’s because these latest figures are based on surveys of employers and households that were conducted March 7–14.

In a more up-to-date snapshot, the Labor Department reported yesterday that a record 6.6 million Americans filed for unemployment claims last week. (Before the spread of COVID-19, the highest number on record had been 695,000 during a week in 1982).

In February, the unemployment rate had dipped to 3.5% — the lowest it’s been in more than 50 years. Economists expect the unemployment rate will soon surpass the Great Recession high of 10%.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.