Why are Federal Reserve regional banks listed on U.S. currency?

Share Now on:

Why are Federal Reserve regional banks listed on U.S. currency?

This is just one of the stories from our “I’ve Always Wondered” series, where we tackle all of your questions about the world of business, no matter how big or small. Ever wondered if recycling is worth it? Or how store brands stack up against name brands? Check out more from the series here.

Listener Lorenzo Boido asks:

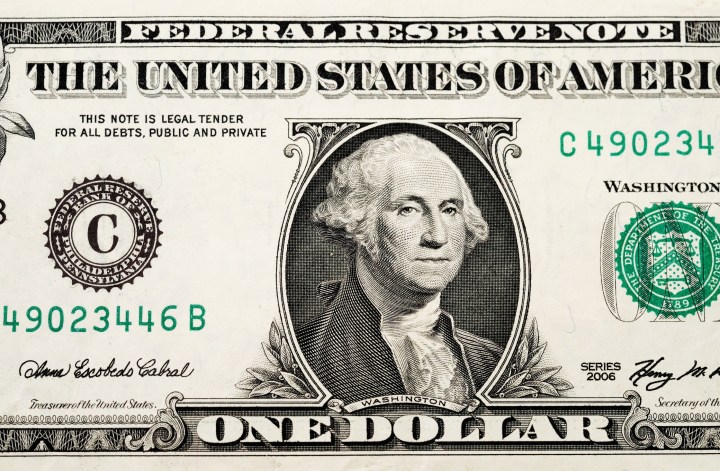

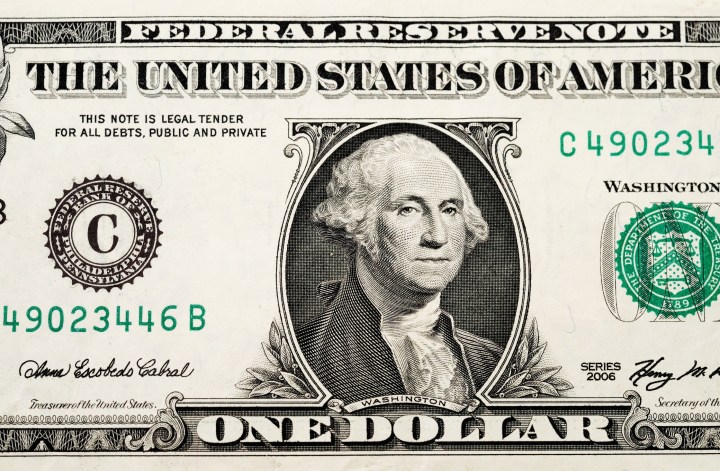

U.S. paper currency has the name of one individual Federal Reserve Bank printed on the left-hand portion on the obverse side. Why? I thought that this was central banking?

Every bill you own tells you which part of the U.S. it came from.

On $1 and $2 bills, you’ll find a left-hand seal with the name of the regional Federal Reserve bank that distributed it. On other denominations, there is a letter-number combo that represents the regional bank.

To the casual eye, this designation probably seems like one of the least interesting parts of our currency, behind the actual denomination, the political figurehead in the middle and that creepy eye on the back (in the case of the $1 bill).

But while it’s not linked to conspiracy theories about the Illuminati, the seal still has an important backstory and purpose. Experts say this label is a legal reminder of which regional bank is liable for the bill. It’s also a reflection of our banking system’s need to serve different parts of the country and a symbol of the public’s distrust of Wall Street.

There are 12 regional Federal Reserve Banks — which distribute currency of all denominations — that are located in Atlanta, Boston, Chicago, Cleveland, Dallas, Kansas City, Minneapolis, New York, Philadelphia, Richmond, San Francisco and St. Louis.

Each of the 12 regional Federal Reserve Banks is an independent corporation with its own corporate charter and board of directors, according to Gary Richardson, an economics professor at the University of California, Irvine, and a former historian with the Federal Reserve System.

These entities are legally banks, and each piece of paper currency has to tell you which bank is liable for it.

“The notes are kind of identical and sort of function identically. But legally, the notes have to be issued by a specific bank. And then they’re backed by the assets of that specific bank,” Richardson said. “If for some reason a Federal Reserve Bank doesn’t have enough assets to cover its notes, the [Federal Reserve] Board of Governors can actually force the commercial banks in that district, that are members of the Federal Reserve System, to pay in more money to the Federal Reserve to cover the notes.”

If the commercial banks can’t step in, then the federal government would, Richardson added.

Let’s take the Federal Reserve Bank of Dallas, for example, which issues a certain amount of money.

“On the liability side of its ledger, it lists these notes in circulation. The law says there are certain assets that the Dallas Fed has which back those notes in circulation,” Richardson explained. “So the liability is matched by an asset.”

Going for gold

In the past, a significant proportion of these assets took the form of gold, back when we were on the gold standard.

Before 1934, you could walk into a Federal Reserve regional bank with a note that had the name of that bank on it, and the bank would convert it into gold, Richardson said. While $5, $10, $20 and $100 bills now have codes that represent the banks, these bills used to clearly state which banks they came from for most of the 20th century.

“[Federal Reserve Banks] were actually required to keep on hand, in their vaults, at least 40% of the gold they owed to the holders, “Richardson said. “So if the Dallas Fed had a million dollars in paper notes in circulation, it would have to keep in its vaults a minimum of $400,000 in gold.”

But in 1933, amid the Great Depression, there was a nationwide banking crisis. There were a series of factors that triggered the crisis, including previous banking failures and concern over whether the U.S. would stay on the gold standard, explained Richardson.

“People pulled their money out of banks. And if they could, they took their paper dollars and converted them to gold,” Richardson said. “The Federal Reserve Banks started to run short because they didn’t hold enough gold to pay off every single paper dollar they issued.”

When President Franklin D. Roosevelt took office in March of 1933, he proclaimed a bank holiday, halting all banking transactions. In April, he called for the public to return gold coins and gold certificates worth more than $100 to banks in exchange for paper money.

By early next year, Roosevelt had signed the Gold Reserve Act of 1934, which transferred ownership of the country’s monetary gold from the Federal Reserve System to the U.S. Treasury. The U.S. Treasury and financial institutions were also banned from converting paper dollars into gold.

Nowadays, the Federal Reserve regional banks are generally backed by U.S. government bonds.

As for whether you could try converting your bills if you waltzed into one these days? “They’d probably think you’re crazy and arrest you,” Richardson said.

Why we have regional Federal Reserve Banks

In the past, there were different currencies, with some issued by the U.S. Treasury and some issued by the Federal Reserve system and the Federal Reserve regional banks, according to Franklin Noll, a payments specialist expert with the Federal Reserve Bank of Kansas City. But since the 1960s, all U.S. bills have been issued by the Federal Reserve System through the Federal Reserve regional banks, Noll explained.

The practice of listing regional Federal Reserve Banks started in 1914, shortly after the creation of the Federal Reserve System. “In order to cover the entire country, you had to have regional banks,” Noll explained.

Back in those days, Noll said, shipping items across the country wasn’t an easy task.

“Banks within, say, the area of the Richmond Fed would send in their cash orders to the Richmond Fed and say, ‘I need so many 100s, so many 10s, so many 5s, and then those would be delivered from the Fed to whatever bank ordered them,” Noll said.

Gary Richardson said lawmakers debated whether there should be regional banks vs. one central bank. There was a proposal for a National Reserve Association, which generated opposition — particularly from the Democratic party, Richardson said. Critics said it gave “too little control to the government and too much power to bankers,” according to the Federal Reserve History website.

“The politicians who set up the Federal Reserve System, and a lot of the public, distrusted Wall Street,” Richardson said. “Having this regional structure limited the influence Wall Street would have on the Central Bank.”

He said that if the system is working as intended, the origins of those regional Federal Reserve seals should be a curiosity. Many of us probably weren’t aware that the left-hand seal on our money means that if that particular Federal Reserve Bank can’t cover that note, commercial banks would have to step in. And that’s because that’s not something we’ve witnessed in our lifetimes.

“That’s what we always hope — it’s just a curiosity. We don’t ever want the government going around to commercial banks and saying, ‘Hey, you know, we kind of screwed up so you guys got to pay a lot of money to fix the system,’” Richardson said.

But, he added, those images and words are there for a purpose. They reflect promises that the monetary system is safe and will be safe if it ever runs into problems.

“Those promises are there because you want people to use the money and you want people who use money to be confident of its value,” Richardson said.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.