Some NYC businesses are trying to negotiate for lower rent

Some NYC businesses are trying to negotiate for lower rent

During the pandemic, many of New York City’s small businesses have struggled to keep up with the city’s expensive commercial rents.

Joanne Kwong, the president of Manhattan retailer Pearl River Mart, said she was paying around $1 million a year in rent for two locations and a warehouse before the pandemic. She said negotiating to try and get a break on her rent is like rolling the dice.

“Our situation is kind of dependent on the whims or the situation of the landlord,” she said.

She said one of Pearl River Mart’s landlords has agreed to reduced rent. Another is demanding 100% of it. Kwong said Pearl River Mart might have to leave that location.

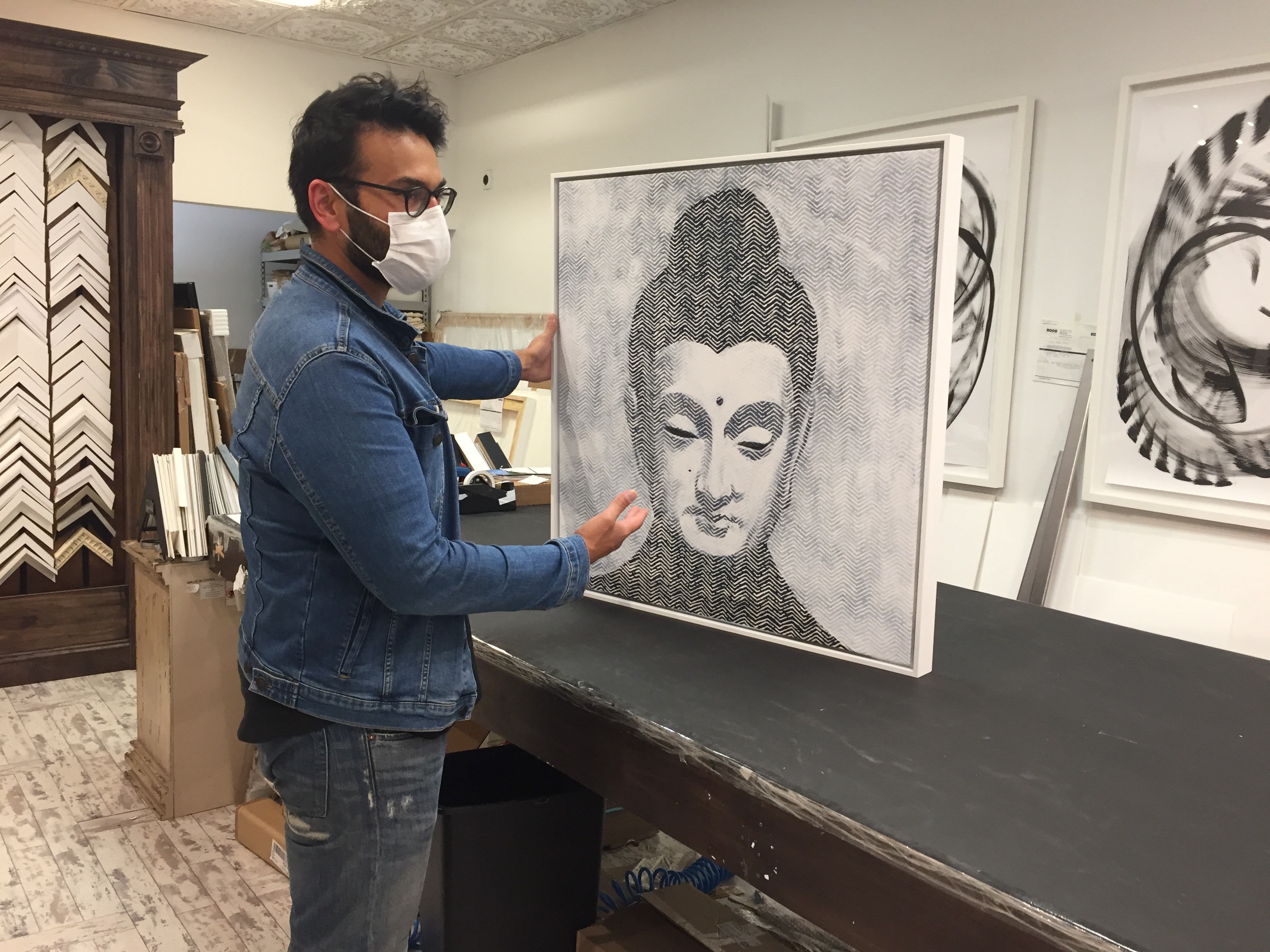

Jawed Farooqi said his revenues have been down almost 60% during the pandemic. He owns a framing store, called Rooq, with three locations in Manhattan. Farooqi said one of his landlords has reduced the rent, another argues about it every month and a third won’t negotiate.

“I was explaining to him that every day I see a new store closing, and he’s like, yeah, you’re right. And I’m like ‘So you know that this is how it is, why do we have to fight?'” he said.

Commercial leases in New York tend to be long and they are not very flexible, said Rachel Meltzer, who teaches urban policy at the New School. And, the city doesn’t have a consistent way of regulating commercial rents, even in normal times, she said. “It’s hard to come up with something systematic in the middle of a crisis,” she said.

Meltzer said right now money would be the best equalizer. “Some kind of bailout, just to support these businesses and help them pay whatever rent they have to pay,” she said.

But small businesses do have some leverage. Nicole LaRusso, director of research and analysis for CBRE Tri-State, a real estate services firm, said in New York City, rents are down and vacancies are up.

“There’s not a lot of tenants lined up, waiting for tenant X to move out so tenant Y can move in,” she said.

So if landlords don’t negotiate, they may be rolling the dice too.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.