What happens when venture capital money runs out?

Uber. Lyft. Snapchat. These ubiquitous companies rarely, if ever, turn a profit; venture capital funding made them household names. So what happens when the VC money dries up? Some of them crash pretty spectacularly.

Take WeWork, MoviePass, and Blue Apron, the company that delivers meal kits to people’s homes. Those companies attracted hundreds of millions in venture cash.

Blue Apron pulled in $135 million in venture funding in 2015. What happened next is treated as a cautionary tale: the company went public in 2017 and, because of precipitously declining sales, is seen as a sinking ship.

“It’s a disaster for the employees”, says Vivek Wadhwa, a professor at Carnegie Mellon University. “They worked day and night, literally 80, 90 hours a week, took reduced salaries … and then what?”

While venture capital fundamentally supports innovation, that money can also spoil companies.

“You can spend tons of it to force growth,” said Eric Gordon, professor at the University of Michigan. “Once you go public, you cant spend four dollars to produce $2 of revenue.”

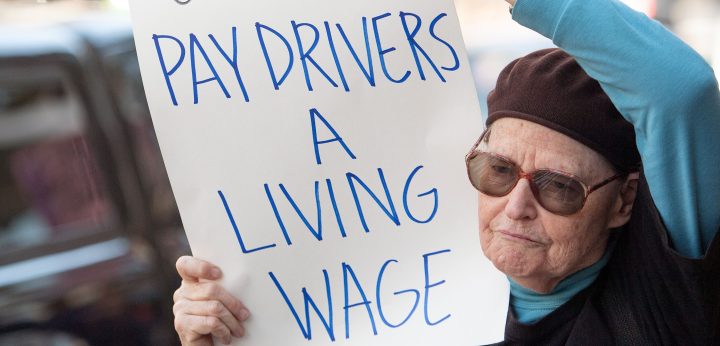

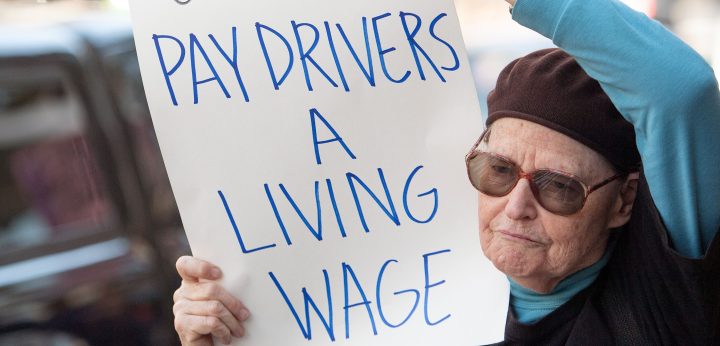

Uber is one company many are surprised to find out has never turned a profit. It just announced it will pay drivers to place ads on the roofs of some vehicles. That’s a money-making move by a company notorious for burning through venture capital. Now that it’s public, it’s still not making a profit.

Gene Munster, co-founder of venture capital firm Loup, warned against putting all startup companies in the same bag.

“There are some companies that should be held to a high standard of profitability at a very early stage. Because they are not in these massively transformative markets. That would be Blue Apron, for example, or Movie Pass,” he said. In other words, meal kits and movie tickets are discretionary fun, while efficient transportation is a need.

Startups are rarely as popular as Uber, though. And when their venture capital money dries up, they have limited options: sell, get loan money, go public and risk fizzling or … shut down altogether.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.