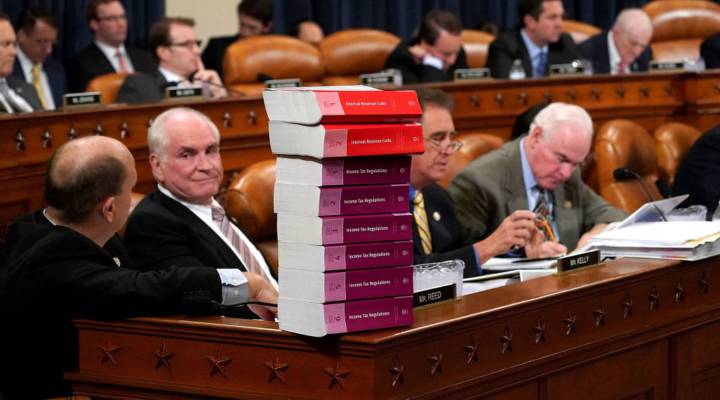

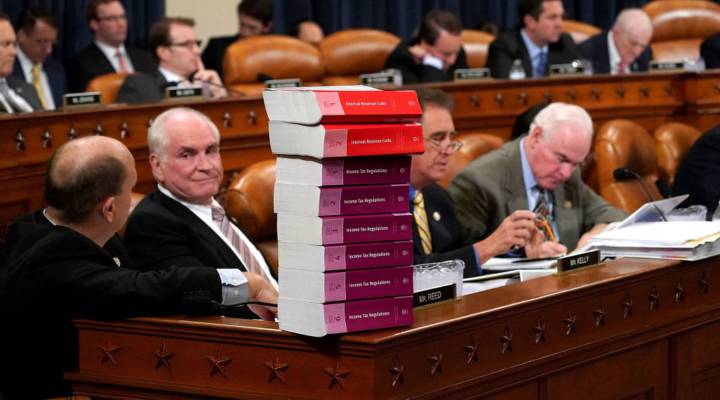

How the U.S. tax code makes inequality worse

How the U.S. tax code makes inequality worse

People don’t disclose their race or gender when they file their taxes. But new research shows how someone’s background can affect their tax bill.

Now a report from the Center on Budget and Policy Priorities highlights the way the tax code contributes to income inequality with tax breaks that favor the wealthy, especially those earning income from investments, real estate or inheritance, compared to those who just bring home a paycheck.

The National Women’s Law Center also argues that specific provisions built into the tax code create distinct disadvantages for women, women of color in particular.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.