The tricky business of investment restrictions

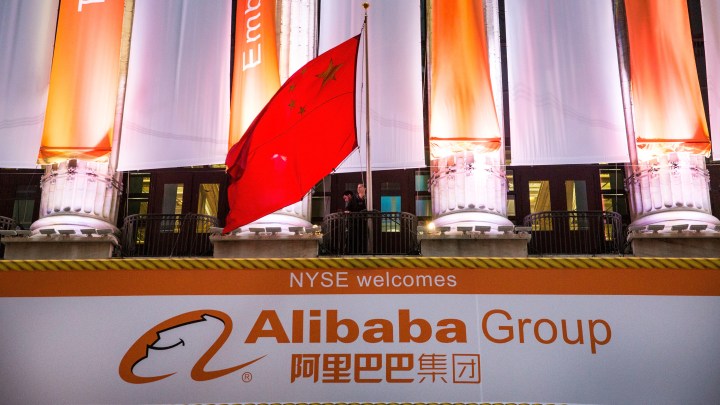

The Trump administration may be considering slapping restrictions on U.S. investments on China, according to reports late last week. The moves could force some Chinese companies to delist from American stock exchanges and prevent U.S. government pension funds from investing in the Chinese market.

A Treasury spokesperson said this weekend that there’s no plan to block Chinese companies from listing shares on U.S. exchanges at this time, but didn’t address the rest of the reports. However, the idea of investment restrictions has also been kicking around Congress in at least two pieces of pending legislation.

Click the audio player above to hear the full story.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.