What the Beatles taught us about tax policy

What the Beatles taught us about tax policy

This is part of our “Econ Extra Credit” project, where we read an introductory economics textbook provided by the nonprofit Core Econ together with our listeners.

Last month, a group of ultra-wealthy people who call themselves the Patriotic Millionaires wrote to leaders at the World Economic Forum calling for higher taxation of themselves and others in their tax bracket in order to combat wealth inequality.

The idea that people generally care about fairness, even if it means parting with some of their own money, is one takeaway of this week’s economics lesson about designing fair and efficient public policy.

But policies don’t always produce the outcomes lawmakers intend. A high redistributive tax might incentivize people to avoid paying it if it’s more cost-effective to move money offshore or hire specialized accountants to exploit loopholes in the tax codes. (A 2018 IMF report that found that $12 trillion, nearly 40% of foreign direct investment globally, is “phantom corporate investment” sitting in shell companies in well-known tax havens.)

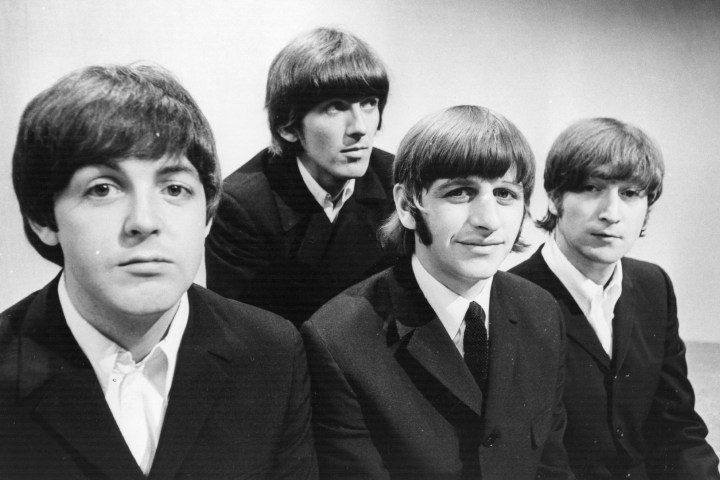

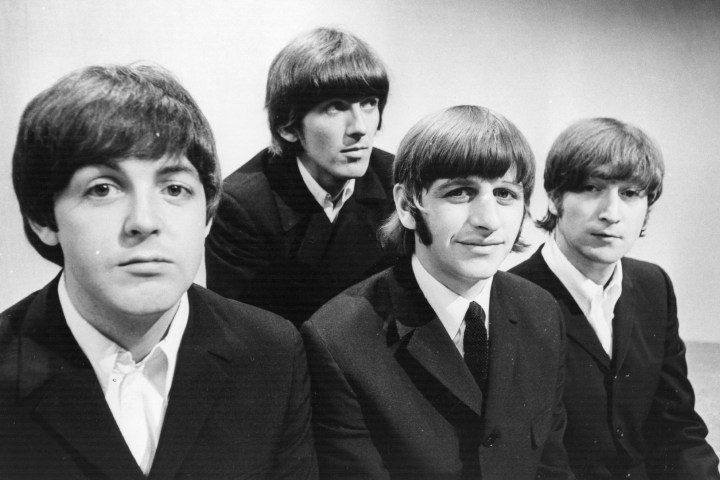

Case in point: in the mid-1960s, the British government introduced a 95% “supertax” on the some of the United Kingdom’s wealthiest residents.

Among that group were the Beatles, who gave us the 1966 protest-anthem “Taxman” in response: “Should 5% appear too small / Be thankful I don’t take it all / ‘Cause I’m the taxman, yeah, I’m the taxman.”

The Beatles eventually to set up Apple Corps, Limited, a company that let them sidestep the high income tax and instead pay a lower, corporate tax rate.

Click the audio player above to hear the full story.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.