Canada’s oil sands reach for U.S. markets

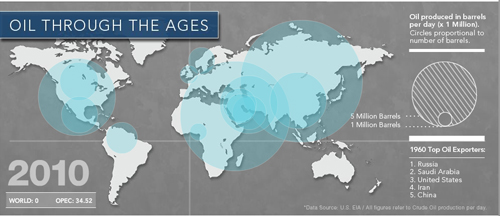

Kai Ryssdal: We are, as presidents as far back as Richard Nixon have told us, addicted to foreign oil. Saudi Arabian oil. Mexican oil. Nigerian oil. Far and away the leading source of American crude, though, are those nice people north of the border. Canadians want to sell us even more oil, too, via a giant new pipeline running from Alberta all the way down to South Texas called the Keystone XL.

There’s a fight going on in Washington, though. It’s about the pipeline, a little, but mostly, about whether we should be burning Canadian oil at all. Marketplace’s Scott Tong ventured forth from our sustainability desk made his way up to Alberta to check it all out.

Scott Tong: This pipeline fight is over the most expensive oil in the world. Oil companies drilling in the Canadian oil sands typically spend $60 or more to produce one barrel of crude. It’s what’s called tough oil — it takes a lot of energy, geology, and fancy acronyms.

Drew Zieglgansberger: Probably the most advanced technology right now is called SAGD, or it stands for Steam-Assisted Gravity Drainage.

Drew Zieglgansberger is vice president at the Canadian oil firm Cenovus. We’re on a bus, touring their operations in middle-of-nowhere, Alberta. He says the world’s easy oil is gone.

Zieglgansberger: The oil now that people are looking for are not the nice light oil sitting in pools that you drill into it and it just flows by itself.

What’s left is in remote places, often way underground. As for the oil sands, they’re not even a liquid.

Zieglgansberger: It’s basically a solid matter. It’s very much like a shoe polish. It’s hard and it’s… if you put it in a cup it would be there forever. If you dump it out, it’d be like dumping some wet sand in your sandbox.

Still, processing the oil sands is worth it, ’cause American import one hundred barrels of crude, every second. That comes out to 24,000 barrels by the time this story is over. Or one million gallons. The key ingredient to oil sands is heat: you send steam down a well, turn the sand into liquid, and pump it.

Zieglgansberger: This is basically a big, big boiler.

The steam source runs almost 3000 degrees Fahrenheit. Great big fire.

Zieglgansberger: This is where we’re burning natural gas. If you look at a normal barbecue, your barbecue is probably about 30,000 or 40,000 BTU of heat, maybe. This one generator is 250 million. It’s a massive amount of energy.

There’s the rub. In some cases, the energy put in equals what you get out.

Not worth it, says Calgary author Andrew Nikiforuk. His book is called Tar Sands.

Andrew Nikiforuk: The returns are absolutely minimal. It takes one barrel of oil or oil equivalent to get one-and-one-half barrels. Some steam plants are getting even negative returns.

Energy use makes the oil sands process emit 17 percent more greenhouse gases than normal oil — according to a U.S. government study. Critics say that makes for one of the dirtiest crudes in the world, not to mention the chemical wastewater, and clearing of forests for mining.

Canadian activist Danielle Droitsch is with the Pembina Institute.

Danielle Droitsch: It’s similar to Venezuela. It is similar to Nigerian oil. So it’s sort of the worst of the worst.

Droitsch moved to D.C. last year, in her view to keep the oil sands industry honest. She’s fighting the expansion of a pipeline carrying Canadian oil sands crude to the United States. And for now it is stalled. The application’s been at the State Department for 33 months. Opponents like Droitsch think choking off supply will help choke off oil addiction quickly. But the reality of driving suggests, maybe not.

Analyst Jim Burkhard at IHS Cambridge Energy says most of us own our cars for a decade or more. So it’ll take a long time to retire a whole generation of oil guzzlers.

Jim Burkhard: So even if we have stunning success in electric vehicles, it will take decades before we see that reduce overall global oil demand.

That’s why every big oil company in the world is investing in Canada’s oil sands. Leading the surge: Drew Zieglgansburger at Cenovus.

Zieglgansburger: We can expand as much as quick as 20 times in less than a decade. Right now, for the foreseeable future, our foot is on the gas.

Perfectly fine pun, which I will butcher by saying, down the road, there’s a danger sign. It reads: Pipeline Uncertainty.

Calgary analyst David Yager.

David Yager: There comes a point where if you can’t move this oil, you’ve got to say yeah this is a problem. If I can’t get access to markets, there’s no point.

So the push the pipeline, industry has taken out ads, like this…

American Petroleum Institute ad: What would you think if I told you we import more from Canada by far than from any other country in the world? That’s great, Canada is our neighbor. Let’s get started right now.

The obvious pitch is: Canada, so not the Middle East. They’re are also playing the China card — if the Americans don’t want Canadian crude, they’ll sell it to those guys. The stakes are high for the other side, too.

Danielle Droitsch at the Pembina Institute says this is no longer just about a pipeline. It’s fundamentally about the oil sands and about climate.

Droitsch: This pipeline is really about whether this administration is serious about climate policy when it comes to reducing oil dependence. That’s sort of what this has become.

Word is the Obama administration considers this a lose-lose situation. Either they anger environmentalists, or energy users. The pipeline decision is expected by December. ‘Til then, the energy pros will be mining and steaming away.

In Alberta, I’m Scott Tong for Marketplace.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.