“Suppliers are sexy,” but the real oil collapse story is demand

“Suppliers are sexy,” but the real oil collapse story is demand

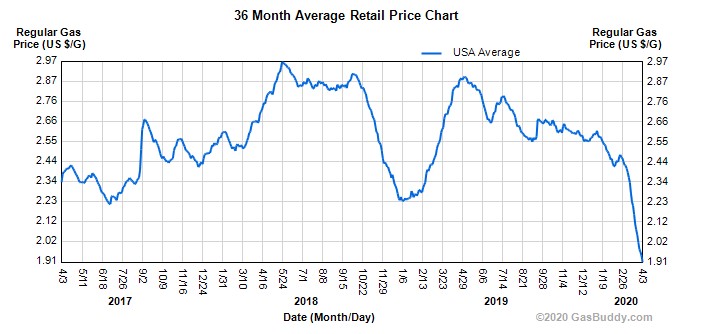

Oil prices spiked this week on news that key producers — Saudi Arabia, Russia and perhaps the state of Texas — could arrange a coordinated cut in supply. But the defining story of oil in the age of global coronavirus is not supply, analysts say. It’s a historic plunge in demand that has pushed U.S. average gasoline prices to $1.91 a gallon.

Except in China, where virus-related travel restrictions are being lifted, most people in the world are not moving. Oil, of course, is for moving. Many analysts project that world demand for crude in April could plummet by 30%. That would be the worst dive ever — almost.

“We saw an equivalent drop from 1929 to 1934,” Philip Verleger, longtime energy economist and senior energy adviser in the Carter administration, said. “Crude prices went from $2 a barrel to 25 cents. A 90% drop.”

To avoid a repeat of that, oil producers are trying to respond. American oil and gas executives met at the White House Friday to discuss policy responses. And Monday, representatives of OPEC and Russia are expected to meet by video to consider joint supply cuts. But to many, discussions of oil supply are a sideshow.

“You know, the suppliers are sexy and the demand is boring,” Sarah Ladislaw, energy fellow and vice president at the Center for Strategic and International Studies. “But the reality is that there’s probably not a lot suppliers can do in terms of supply cuts, because the demand destruction is just so large.”

There’s probably not a lot suppliers can do … demand destruction is just so large.

Sarah Ladislaw, Center for Strategic and International Studies

Because demand has plunged spectacularly, the world’s oil is projected to run out of storage space in the next few months. Crude oil would physically have no place to go, forcing producers to stop pumping abruptly. Prices could collapse further. To avoid that scenario, the world’s largest oil suppliers are mulling unheard of supply cuts to match the historic destruction in demand.

“Russia, Saudi Arabia and the U.S. are producing something like 35 million barrels” per day, Per Magnus Nysveen, lead analyst and senior partner of Rystad Energy, said. “If they are cutting up to 15 million barrels [daily], they are cutting up to half their production. Extremely dramatic.”

They are trying to survive until a possible recovery in demand next year. Ladislaw, however, warns that would only happen if the virus is contained and people are and driving and flying again.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.