It’s Halloween, and Bridget and Ryan are trying to answer a question about the national debt while preparing for their town’s giant Halloween extravaganza. The town has taken on debt to make things extra spooky this year and things are starting to get a little out of control! Can Bridget and Ryan help the town navigate their monster debt?

(Grownups: This is episode does contain monsters but no jump scares! You know your kid listeners best, so exercise caution if Halloween is more tricky than treat for them!)

After you listen to the episode, here are some questions and conversation starters you can use with your kid listener to see how much they learned about the national debt:

Why might the government need to borrow money and go into debt?

What would you do if you wanted something right now, but didn’t have enough money for it?

*Bonus* Not-So-Random Question: Have you ever lent money to a friend? Why or why not?

For listeners who want to keep learning, we’ve got some ideas:

This isn’t the first time debt has made an appearance on Million Bazillion! Listen to this Million Bazillion episode to find out more the type of debt a person might take on.

If you’re wondering – why can’t the U.S. just print more money to pay off its debt, take a listen to this Million Bazillion episode about inflation.

Check out this short video by PBS to help your understanding of the National Debt.

Click here to learn the history of the U.S National Debt!

If your listener likes a scare, consider a double feature of Halloween fun with this episode about recessions, where a recession monster threatens the economy until the Recession Crushers show up!

Thanks for listening to this episode! If your kid listener has a money or economy question from something they’ve heard on the news, we’d love to help answer it!

Record your Million Bazillionaire and send the audio using this online form and we just might include your kid in an upcoming episode!

This episode is sponsored by Greenlight. Sign up for Greenlight today at greenlight.com/million.

Note: Marketplace podcasts are meant to be heard, with emphasis, tone and audio elements a transcript can’t capture. Scripts may contain errors. Please check the corresponding audio before quoting it.

NIGHT OF THE LIVING DEBT

Cold Open:

(MUSIC: SPOOKY THEREMIN MUSIC)

RYAN: Attention Million Bazillion listeners… beware! The episode you are about to hear is extremely scary. Muhahaha!

(STOP MUSIC)

BRIDGET: What are you talking about? I don’t think this episode is scary.

(MUSIC: SPOOKY THEREMIN MUSIC)

RYAN: Well, maybe it’s not the scariest thing you’ve ever heard, but it is a Halloween-themed episode. So still scarier than a normal show! Muhahaha!

(STOP MUSIC)

BRIDGET: Wait, what part is scary? I’m struggling to think of even one scary moment. I mean, sure, I guess some of the economic concepts in it are kinda scary, but-

(MUSIC: SPOOKY THEREMIN MUSIC)

RYAN: Yes! So scary, you shouldn’t listen to this podcast unless you’re at least… 18 years old! Muahaha!

(STOP MUSIC)

BRIDGET: Wait, I think younger kids can listen to this show and they’ll be fine. It is a show for kids after all.

RYAN: (HUSHED) Bridget, this is our Halloween episode, we gotta put some kind of age limit on it, so it seems cool if you can get away with listening to it. How bout-

(MUSIC: SPOOKY THEREMIN MUSIC)

RYAN: You can’t listen to this show unless you’re at least two years old! Muhahaha!

(STOP MUSIC)

BRIDGET: Well, now that’s too young.

(MUSIC: SPOOKY THEREMIN MUSIC)

RYAN: Ok, fine! Anyone can listen, this episode isn’t very scary, but it is about Halloween! So… prepare to be filled with fright! Muhahahaha!

(MUSIC COMES TO CLIMAX)

BRIDGET: Sooo, can we start the episode now?

RYAN: Yes.

–Theme Music–

(SFX: CROWDED TOWN HALL)

RYAN: Welcome to Million Bazillion. I’m Ryan!

BRIDGET: I’m Bridget! And We Help Dollars Make More Sense.

RYAN: Bridget and I are here at a town hall meeting to discuss how the big public Halloween celebration is gonna go down this year.

BRIDGET: (MIFFED) Why is this is the only town hall meeting anyone ever shows up to? No one went to my meeting about fixing that pothole on Sullivan Street.

RYAN: Well, maybe you should’ve added the promise of candy and costumes to juice up a sort of dry topic. Speaking of which, let’s listen to today’s Million Bazillion listener question.

DEJI: “Hello, my name is Deji from Cypress, Texas. I want to know how much debt is too much debt.

RYAN: Wait a second, didn’t we answer this question last season?

BRIDGET: We did, it was an episode about what happens when a person takes on too much debt…but it turns out, that wasn’t the debt Deji was asking about.

DEJI: I ask because I know that countries sometimes have to borrow to do their job. Is there an amount of debt that would be considered too much for the government to function?”

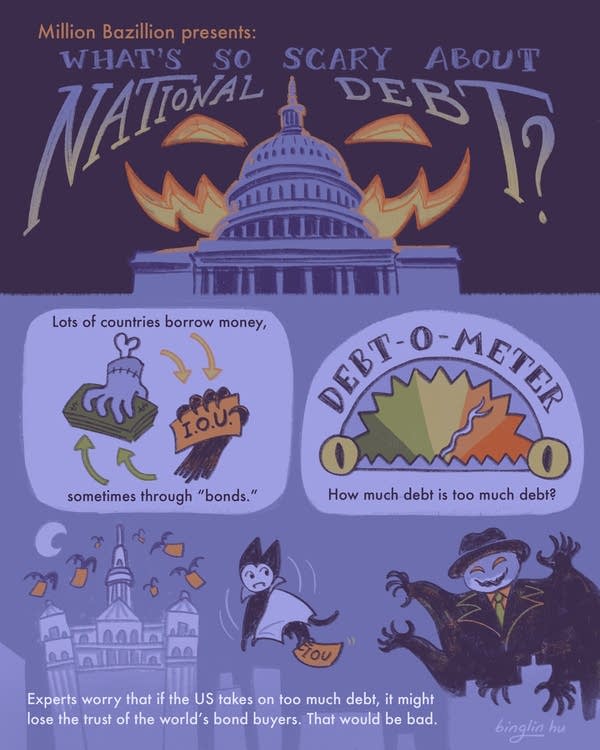

BRIDGET: Deji wanted to know about the NATIONAL debt. He's right, governments around the world do borrow money. If you’re the U.S. government, a LOT of money. But could they ever borrow too much? Yep, this the perfect question for a Halloween episode since the national debt is something that some grownups find very scary.

(SFX: HALLOWEEN STING OR THUNDER CRACK)

RYAN: Why would a grownup be scared of the national debt?

BRIDGET: Not totally sure. It’s one of those very grownup things to be worried about, you know, like joint stiffness or catalytic converter theft. But anyway, let’s get to the parts we do know.

(MUSIC: EXPLAINER MUSIC)

BRIDGET: The national debt is money the government owes.

RYAN: OK but …to WHO? Like, who does the US owe? Cause that’s important. As the old guys I hang around with at the racetrack say, “It’s not how much debt you owe, but who you owe it to. Hey, can you open this soda for me, my thumbs are currently broken.”

BRIDGET: Well, what would you say if I told you we owe a lot of that debt… to ourselves?!

RYAN: (INCREDULOUS) Whaaaa? But how?

BRIDGET: Okay so, regular people can go to a bank to ask for a loan. Governments CAN do that, but they can also raise money by offering something called bonds. Bonds are like a tiny little loan that regular people give the government.. A government would say, [QUOTING] hey, who wants to lend me some money? I’ll pay it back with interest at a certain time in the future. I promise! All you have to do is buy this little bond I’m offering. [NORMAL VOICE] Lots of governments do this. It’s really just a loan!

RYAN: (SEAN CONNERY) But it’s called a bond. Government Bond.

(MUSIC: 007 TYPE STING)

BRIDGET: Bonds, especially the ones sold by the U.S. government are considered pretty safe investments. Because everyone trusts that the U.S. government is going to pay back that loan. So lots of people buy them, from banks, to grandmas, you name it.

RYAN: OK but why doesn’t the government even need to borrow money? Isn’t that why we pay taxes - so that the government can pay for stuff? Why would they need more on top of that?

BRIDGET: Well kinda for the same reasons regular people take out loans. For BIG expenses. Sometimes, for something unexpected, like a pandemic or other crisis. Sometimes as an investment for big opportunities, like to build new infrastructure. The country maybe doesn't have all that money right away, but it will have it in the future, because remember, they’re gonna be collecting taxes every year! But in the meantime - Bonds!

(SFX: END EXPLAINER MUSIC)

(SFX: MIC FEEDBACK)

(SFX: CROWD SETTLES DOWN)

MAYOR: (INTO MIC) Ok everyone, please take your seats. In one minute, we’re gonna convene our big meeting on this year’s town-wide Halloween extravaganza!

(SFX: CHEERS AND WHOOPS FROM THE AUDIENCE)

BRIDGET: (HUSHED) Oh boy, not much time before the big meeting starts.

RYAN: Let’s take a quick break and we’ll be right back with more unspeakably terrifying horrors-

BRIDGET: Ryan.

RYAN: Alriiight, more moderately worrisome concepts… right after this!

–ARK–

KIMBERLY: And now … it’s time for Asking Random Kids Not-So-Random Questions … Today’s question is: Have you ever lent money to a friend?

–

No, because I don't really trust it.

I have, and it's just because I wanted to be nice

I have never lent money to a friend but i have given my friends money if they wanted something and they had extra money.

Not that I can think of because they never asked for it.

I have! I lent money to Peter to buy a stuffed animal he really really wanted and he thanked me afterwards and it felt really nice.

I’ve never lent money to a friend because I don’t want them to be in debt with me

–

KIMBERLY: That was …

Livia and Damian in Illinois

John and Peter in New Jersey

Joshua and Coralie in California

This has been Asking Random Kids Not-So-Random Questions.

Part 1:

BRIDGET: Welcome back to Million Bazillion, today’s episode is all about the national debt, which is actually a kind of a hard topic to unravel. I wish we had an episode-length metaphor to explain it all but I’m having trouble thinking of one.

RYAN: Shhh, shhh, the big town hall is about to start.

(SFX: TOWN HALL CROWD)

(SFX: GAVEL BANG)

(NOTE: MAYOR IS TALKING INTO AMPLIFIED MIC)

MAYOR: Alright everyone, let’s begin. I’m Mayor Angelopoulos, as you know. And today, we’re kicking off the discussion of this year’s Halloween celebration. Now I know everyone’s excited, but as usual, we have a budget and we need to balance our list of “needs” with our list of “wants” –

(SFX: SEATS SHIFT AS HANDS RAISE)

TOWNSPERSON #1: (OFF-MIC) Um, not sure what you’re on about, but I think we should bring back the haunted bouncehouse from last year, but this time, make it a mega-sized, mile-long haunted bouncy maze with spiderwebs and jump scares behind every corner!

(SFX: SCATTERED CLAPS)

MAYOR: Ok, good suggestion, but I think that would probably cost a whole lot. Now I know we’re able to be GENEROUS with our Halloween spending, because of those Halloween bonds we’ve been selling. [DUCK UNDER] But we still have a budget to think of, so back to what I was saying about needs and wants…it’s high time we talk about-

BRIDGET: [LOUD WHISPERING] Wait, Ryan! Did you hear that? This town has been taking on debt to pay for their Halloween celebration! Maybe THIS is how we answer Deeji’s question! We just follow THIS town, and see what happens next!

RYAN: A spooktacular idea, Bridget!

TOWNSPERSON #2: I’ve been saying it for years now, but we should get a real monster for our celebration. Imagine how scary that’d be, to have an actual live monster on display. No other town would have something that cool!

(SFX: SCATTERED CLAPS)

TOWNSPERSON #1: Yeah, We should pay for that!

MAYOR: Right right, but to reiterate-. That won’t fit into the budget. .

TOWNSPERSON #2: Then let’s just borrow more money!

MAYOR: Do you realize how much money it would cost to capture and feed a monster?

TOWNSPERSON #3: Can we please talk about our librarian’s witch costumes? A lot of them don’t even have pointy hats anymore! A witch without a pointy hat just looks like someone’s aunt in a kaftan.

(SFX: SCATTERED CLAPS)

RYAN: Here! Here! Finally someone said it!

MAYOR: Ok, duly noted. So borrowing money sounds like a popular idea. But don’t just yell things out. Wait your turn at the mic, like these two here. Young lady, what’s your name?

BRIDGET: Bridget Bodnar, you may remember me from my proposal to fix that pothole on Sullivan Street.

MAYOR: Oh yeah, I remember that meeting, (ASIDE) Snooze City.

(SFX: LIGHT LAUGHS)

RYAN: And I’m Ryan, a guy.

MAYOR: So what’s on your mind, Bridget and Ryan? You got 2 minutes.

BRIDGET: (INTO MIC) Well, this whole situation reminds me of a very important problem facing the U.S. federal government!

TOWNSPERSON #3: Their witch costumes don’t have pointy hats either?

BRIDGET (INTO MIC): No! The U.S. owes a lot of debt right now, and people are not happy about it! Because you have to be careful about taking on too much debt, it can become a real problem!

MAYOR: Like how much are we talking here?

BRIDGET: Oh it’s big. Would you believe me if I said, $37 trillion!

MAYOR: Sure, but is that a lot of money? The U.S. government is a country, everything they do is in the billions and trillions and million bazillions! It’s the largest economy in the entire world!

BRIDGET: Okay fair! But when you measure national debt, you compare it to a country’s GDP.

RYAN: Ahh, yes, I have GDP. My therapist says it’s why I have trouble paying attention.

BRIDGET: You mean ADD?

RYAN: Maybe. I wasn’t paying attention.

BRIDGET: No, GDP is something different. It’s the value of all the goods and services that a country produces in a specific time frame.. We use it to measure the health and size of a country’s economy. That 37 trillion dollars the U.S owes is 23% MORE than what our entire country can produce in a year!

MAYOR: And is that… a lot??

BRIDGET: [DRAMATICALLY] Well, kinda yeah? The big worry is that the US would take on so much debt that it would lose the TRUST of potential bond buyers.

MAYOR: Because it didn’t pay back what it borrowed?

BRIDGET: No, surprisingly that’s not the biggest worry. We’re actually worried the U.S. would end up owing so much money that future bond buyers will be weirded out by it and assume our economy will begin to suffer because of it. Or they get all like, [QUOTING] Whoa, a country who can’t manage its debt seems like a country who might make other questionable decisions. [NORMAL] Or even…[QUOTING] Whoa, that’s a lot of debt. Maybe there’s some other country I trust to lend money to MORE.

[BEAT]

MAYOR: So you’re saying no harm in putting on a little debt then?

BRIDGET: I didn’t say that. The United States is an economic superpower with a unique role in the world economy. But that doesn’t mean we can pile on debt, forever!

RYAN: Yeah, it’s like celebrating Halloween- if you’re still doing after thirty, forty years, maybe it’s time to slow down, think of the kids.

MAYOR: So what you’re saying is- if the U.S. government owes more than what it can produce in a year, it’s ok for us to do too?

BRIDGET: Well, no–- no one knows how much debt will officially scare off the world’s bond buyers. We won’t know until we hit it. And then it’ll be too late!

MAYOR: Yeah, yeah, I like how you’re thinking. We’ve been borrowing modestly up until now, But we could go so much bigger! Let’s have another bond sale! And really go for it this time!

TOWNSPERSON #1: And then we can use the money to buy more Halloween things like zombie makeup for our bus drivers and maybe even a second Halloween song that isn’t the Monster Mash!

TOWNSPERSON #3: And, don’t forget pointy witch hats!

(SFX: SCATTERED CLAPS)

TOWNSPERSON #2: I’d put my money in a fund like that! We could even buy a monster!

BRIDGET: But without careful consideration, taking on debt could have disastrous consequences for us all! Like that time I got bangs!

RYAN: I think they looked fine.

BRIDGET: Thanks, but it wasn’t fine! It was a cry for help!

MAYOR: Okay, all in favor of issuing more bonds for our Halloween fund, say “aye”- or wait no, say “boo.”

EVERYONE: (IN UNISON, LIKE GHOSTS) Boooooo!

MAYOR: All opposed say “nay.”

BRIDGET: Nay! I think we should at least talk about it first.

MAYOR: Ok then, it’s settled! We’re going to take on as much debt as we possibly can and have the most amazing Halloween spooktacular ever, one for the ages! Thanks for giving us the idea, Bridget and Ryan. I’m gonna look into where we can find a monster.

(SFX: GAVEL BANGS)

(MUSIC: FOREBODING MUSIC PLAYS FROM HERE TO THE BREAK)

(SFX: TOWNSPEOPLE GETTING UP, EXCITEMENT AND COMMOTION)

TOWNSPERSON 1: I can’t wait to buy me some of those bonds!

TOWNSPERSON 2: Me too! I’m going to get a whole bunch!

BRIDGET: But you guys didn’t listen to me at all!

RYAN: Forget it, Bridget, it’s Halloweentown. Our neighbors are caught up in a zombie-like fervor for debt spending and it’s spreading fast. This is like one of those Twilight Zones where I’m sure we’re all gonna learn a lesson through some metaphor, but we won’t know what it is until the end.

BRIDGET: Ok, well when we come back, we’ll check in on Halloween night at the big spooktacular to see how the town does taking on massive debt. Right after this!

MIDROLL -

Part 2:

(MUSIC: SPOOKY FAIR MUSIC, DIAGETIC OVER SPEAKERS)

(SFX: FAIR CROWD)

BRIDGET: Welcome back to Million Bazillion’s first-ever Halloween Spooktacular where we’re learning all about the national debt.

RYAN: And we just got here, to the big Halloween-night celebration that the town funded through a whole lot of debt. The town sold a bunch of bonds, which means our town is basically borrowing money from- and is in debt to- its own citizens and will have to pay them back at some point.

BRIDGET: Sorta like how our federal government borrows money using treasury bonds.

RYAN: The Mayor even put up this big scoreboard in the center of town that shows the size of the town’s debt. Numbers keep going up. Must be all that interest?

(SFX: SCOREBOARD CLICKETY CLACKING SOUND)

BRIDGET: Yeah, but no one’s thinking about debt tonight even when it’s in glowing numbers in front of their faces because there’s so much cool Halloween stuff here! Look at the werewolf rollercoaster!

(SFX: GROWLING ROLLER COASTER IN DISTANCE)

RYAN: And the vampire bat-ting cages!

(SFX: BATTING SOUNDS)

BRIDGET: And a blob cotton candy machine!

(SFX: BUBBLING BLOB)

BRIDGET: Y’know, looking around, this stuff is… expensive.

FOOD VENDOR: Getcha free gold-plated candy bars! The wrappers are made of real gold, and when you’re done, feel free to keep ‘em or even toss ‘em in the garbage!

BRIDGET: Yeah, I don’t want to rain on this parade-

RYAN: Bridget, please, it’s a scare-ade.

BRIDGET: I don’t want to rain on this scare-ade, but doesn’t this all seem excessive? I can’t imagine this wanton spending is gonna turn out good for us.

(SFX: MIC FEEDBACK)

MAYOR: Attention everyone, thanks for coming out to our biggest Halloween bash yet! Later, we’re gonna bring out Pennywise the Clown! That’s right, we booked the actual Pennywise. But he’s not being scary tonight, he’s just gonna do some balloon tricks for the kids-!

(SFX: CROWD WHOOPS)

RYAN: (HUSHED) Wow, that’s crazy. Pennywise is doing his old material? He never does the old stuff.

MAYOR: But first, we have an extra special surprise we could’ve never brought to you without your purchase of Halloween bonds. Make some noise if you’re the proud owner of Halloween bonds!

(SFX: CROWD WHOOPS)

MAYOR: We owe more than what this town generates in a year, amazing!

(SFX: CROWD WHOOPS)

MAYOR: And tonight, we’re unveiling for the first time… a real monster!

(MUSIC: SCARY MUSIC)

(SFX: CURTAIN PULLED BACK)

(SFX: MONSTER GROWING IN CHAINS)

(SFX: CROWD GASPING AND SCREAMING)

TOWNSPERSON #1: It’s humongous!

TOWNSPERSON #2: It’s hideous!

TOWNSPERSON #1: It’s terrifying!

MAYOR: (EXCITED) I know, right?! It was very expensive to bring here and costs a fortune to feed, but you guys asked for a monster and I’m running for re-election soon and was afraid to let you all down! So enjoy the monster!

(SFX: MONSTER GROWLING)

MAYOR: Uh oh, he’s hungry. Feed him again!

(SFX: BILLS AND COINS COMING OUT OF A BUCKET)

(SFX: MONSTER EATING)

RYAN: Wait a minute? The monster eats money?!

MAYOR: Yeah, weird diet. But rather than buy it food, it just prefers to eat money directly.

SFX: SCOREBOARD NUMBERS INCREASING

TOWNSPERSON #1: (A LITTLE NERVOUS) Um, real quick, speaking of money, wow, look at those numbers ticking up on the debt scoreboard. Is it at all possible this town is in too much debt?

MAYOR: I wish I had the answer to that, but maybe someone else here can help. [PUTS DOWN THE MIC] Bridget, heeeelp!

BRIDGET: Me? How would I know?!?

MAYOR: You’re doing an episode on national debt right now, aren’t you?

BRIDGET: Well, how carefully have you been tracking your ratio of how much debt you owe compared to your GDP, or the value of the goods and services the town creates in the year?

(SFX: LEDGER LANDS ON TABLE, PENCIL SCRATCHING ON PAPER)

MAYOR: (ADDING UP) Hmm, hmmm, … Well, adding this all up, it appears we’ve spent more money on this Halloween bash than the town produces in… about eight years.

TOWNSPERSON #2: Uhhh, that doesn’t seem great. I don’t know if I trust you

MAYOR: But uh, hey, you know, we’ll probably do another bond sale next year for next Halloween if you’re interested!

TOWNSPERSON #2: No way, man!

MAYOR: Ooh, uh-oh. How about if we offer a bigger return on your loan?

BRIDGET: Careful, mayor! If you have to offer a higher interest rate, that means you’re paying more for the loan, it’ll make your debt grow even faster!

MAYOR: Then I guess we could try to make things square by canceling some of next year’s spending. Maybe cut back on public pool and library hours.

BRIDGET: You can cut some spending and divert that money to pay off your debt, but you can’t cut all your spending to fix your debt problem, it’s not like you can cut the fire department to four days a week.

FIRE CHIEF: (YELLING, OFF-MIC) As fire chief, I agree! That would be bad!

MAYOR: Well, I hesitate to propose it, but we could always… raise taxes?

(SFX: LOUD BOOS FROM CROWD)

TOWNSPERSON #1: Noooo! (STARTING A CHANT) Vote out the mayor! Vote out the mayor!

ADDITIONAL TOWNSPEOPLE: Vote out the mayor! Vote out the mayor!

MAYOR: Wait, wait! I was just kidding! Just joking! Don’t vote me out! Don’t even chant about voting me out! Stop the chant!

(SFX: MONSTER GROWLING)

(SFX: BILLS AND COINS COMING OUT OF A BUCKET)

(SFX: MONSTER CHOMPING)

(SFX: SCOREBOARD INCREASING)

TOWNSPERSON #2: But, question remains- How are we adult Halloween celebrators gonna keep making enough money to feed this monster?!?

(SFX: MONSTER GROWLS)

TOWNSPERSON #2: Hey, podcasters! Before this Halloween is totally ruined, maybe you could enlighten us- what is the US government currently doing about its debt? Maybe we can use the same solution?

BRIDGET: Well, would you believe it if I said… nothing?

(SFX: TOWNSPEOPLE GASP)

MAYOR: Nothing!?!

BRIDGET: Yeah, that’s kinda what’s happening right now. The lawmakers in charge know they have to do something. The debt is huge and we’re paying a significant amount of our yearly budget on interest! So either the GDP has to get bigger so the debt looks smaller, or they’re gonna have to make some tough choices. Raise taxes or spend less money. Maybe both!

MAYOR: Both those options seem bad! You know listening to this, I think we should learn from that example and… also not do anything.

TOWNSPERSON #1: Yeah! Not doing anything sounds good to me! I don’t want to stand around here talking about debt! I want to celebrate Halloween!

(SFX: TOWN AGREEMENT SOUNDS. “YEAH, SOUNDS GOOD!”, ETC.)

(SFX: MONSTER ROARS)

MAYOR: I hear you and I see you. We’ve taken long enough out of our celebration to talk debt. Get back to trick-or-treating and enjoying the festivities!

(SFX: CROWD DISPERSES, CARNIVAL SOUNDS RESUME)

BRIDGET: (HUSHED) Mayor Anglelopolous, it’s clear that feeding this money monster is a bad idea. Look at your scoreboard, your debt keeps going up! This could turn out really bad for our town’s economy.

MAYOR: Look, can we table this for a day that’s not Halloween? How bout next month- ahh, wait that’s Thanksgiving. Or how bout December- no, wait that’s ALL the holidays. How bout we reconvene early next year, after my January and February ski trips. And can you do me a favor and feed this monster? The werewolf coaster just broke down and Pennywise is refusing to come out of his trailer because we didn’t get him the Sweetgreen order specified in his rider. Here, Ryan, take the money bucket.

RYAN: Fine, I’ll do it.

(SFX: SCOOPING MONEY, MONSTER DEVOURING IT)

RYAN: Hey, ‘lil guy. You’re not such a scary monster. You like eating your money, don’t you?

(SFX: SCORING FOR A REALIZATION)

RYAN: (BEAT) Wait a minute, Bridget, I think you’ve found the metaphor you’ve been looking for!. Just hear me out, this money-eating monster… is like the national debt.

BRIDGET: (ANNOYED) Yeah. You just now figured that out?

RYAN: Look, I don’t know about literary symbolism and that kinda stuff! My expertise is in money. And feeding it to monsters.

(MUSIC: SUSPENSEFUL)

BRIDGET: Hey, ryan, uh, are you sure that cage is locked? Because it looks like the monster’s trying to open it.

(SFX: CAGE RATTING, MONSTER GROWLING)

RYAN: That cage was made by the finest cage builders. The Trust Cage Company. Oh no! The monster has broken out of the cage! The Trust has broken!!

(SFX: SCARY DISASTER MUSIC)

(SFX: SCREAMS OF TERROR)

BRIDGET: It’s rampaging through the Halloween festival! It’s trying to escape!

(SFX: CAR HONKING, SKIDDING, CRASHING)

BRIDGET: It’s raising interest rates! Now borrowing money is going to get more expensive for everyone!

RYAN: It just drop-kicked the loan the Candy Apple stand was going to get to expand its business into the next county!

BRIDGET: Look, the economy is slowing down! It looks like the entire town is moving through pudding!

RYAN: I think we better cut to a quick break!

MINI SEGMENT- It’s time for Would you rather. I’m Pepper in California. Would you rather buy the coolest halloween costume on your block, or make your own and save money?

Part 3:

(SFX: HALLOWEEN CARNIVAL AMBI

SFX: RAMPAGING NATIONAL DEBT - CAR HONKS, SCREAMS…)

RYAN: And we’re back! Wrapping up our Halloween episode about the national debt and trying to get this Halloween-obsessed town’s National Debt monster back in his cage! Bridget, did anyone learn anything tonight? And if so, can you recap it?

BRIDGET: [PANICKED] Well, I guess we learned that the national debt-

(MUSIC: SPOOKY RECAP MUSIC)

BRIDGET is money the government owes. It’s money they borrowed through something called bonds to pay for things they couldn’t afford at the moment. Deji really wanted to know, is there an amount of money the US could borrow, where they wouldn’t be able to function anymore? Could the US government have too much debt? Well, the U.S. does pay a pretty large chunk of its yearly budget on interest from the national debt. And there is a worry that the US will take on so much debt that future bond buyers won’t have the same trust in our bonds as they do now. So they stop lending us money, or it costs more for us to borrow..

RYAN: If that happens, the government will have to make some tough choices. It might have to raise taxes-

TOWNSPERSON #1 AND 2#: Booo! No!

RYAN: We’re recapping! You can’t boo us while I’m recapping. Or if it doesn’t raise taxes, some of the things that are possible because of our strong economy…might go away. In the meantime, most experts say- it’s not so much about paying off all our debt and getting to zero - it’s about stabilizing the debt- taming the monster, if you will- and getting to the point where it’s more manageable.

(SFX: MONSTER GROWLS)

RYAN: Uh oh. I don’t think the monster liked the recap.

BRIDGET: well maybe took some of the points personally, considering it is a symbol for national debt and all!

RYAN: It’s going into the neighborhood! Headed down Sullivan street!

(SFX: MONSTER GROWLS, FALLS DOWN)

RYAN: Aaaand, looks like it just fell into a hole?

(SFX: MONSTERS MAKES DISAPPOINTED GROWLING NOISE)

BRIDGET: Hmm, good thing we didn’t fix that pothole.

(SFX: LIGHT CHEERS)

–Theme Music-

Credits

RYAN: That’s all for this episode of Million Bazillion! Keep sending us your questions! Check out our website, marketplace dot org slash million for a place to do that!

BRIDGET: While you’re there, sign up for our newsletter. It’s better than those other newsletters out there because we send you new Million Bazillion episodes AS they’re released along with a tipsheet.

RYAN: Don’t sleep on that tipsheet, it’s got some great conversation starters and more ways to learn about the money question of the day -even after the episode ends!

BRIDGET: We had help from the experts for this episode, so special thanks to: Rachel Snyderman, Managing Director of Economic Policy at the Bipartisan Policy Center, and Dr. Reilly White, Associate Dean and Professor of Finance at the University of New Mexico.

RYAN: Million Bazillion is produced by Marketplace from American Public Media. I, Ryan Perez wrote and hosted this episode along with Bridget Bodnar.

BRIDGET: Our senior producer is Marissa Cabrera. Our editor is Jasmine Romero. Flora Warshaw helped produce this episode.

RYAN: It was sound designed by Brendan Dalton

And mixed by Derek Ramirez.

Our theme music was created by Wonderly.

BRIDGET: With additional voicing from Brendan Dalton, Meghan McCarty Carino, Ben Prevor, Jay Siebold, and Alex Simpson.

RYAN: Bridget Bodnar is the Director of Podcasts at Marketplace.

Joanne Griffith is the Chief Content Officer

Neal Scarbrough is the VP and General Manager.

BRIDGET: Million Bazillion is funded in part by the Sy Syms Foundation, partnering with organizations and people working for a better and more just future since 1985. And special thanks to The Ranzetta Family Charitable Fund and Next Gen Personal Finance for providing the start-up funding for this podcast, and continuing to support Marketplace in our work to make younger audiences smarter about the economy.

RYAN: If Million Bazillion is helping your family have important conversations about money, consider making a one-time donation today at marketplace-dot-org-slash-givemillion, and thanks for your support.

The Ranzetta Family Charitable Fund and Next Gen Personal Finance, supports Marketplace’s work to make younger audiences smarter about the economy. Next Gen Personal Finance is a non-profit that believes all students benefit from having a financial education before they cross the stage at high school graduation.

Greenlight is a debit card and money app for kids and teens. Through the Greenlight app, parents can transfer money, automate allowance, manage chores, set flexible spend controls and invest for their kids’ futures (parents can invest on the platform too!) Kids and teens learn to earn, save, spend wisely, give and invest with parental approval. Our mission is to shine a light on the world of money for families and empower parents to raise financially-smart kids. We aim to create a world where every child grows up to be financially healthy and happy. Today, Greenlight serves 5 million+ parents and kids, helping them learn healthy financial habits, collectively save more than $350 million to-date and invest more than $20 million.

The Sy Syms Foundation: Partnering with organizations and people working for a better and more just future since 1985.