Today, we’re talking about bubbles. Not the kind you play with. The kind that happen in the economy! Bridget and Ryan take a trip down memory lane to answer Jocelin’s question about what caused the 2008 housing bubble. With help from Bridget’s unforgettable treehouse bubble tale, we’ll learn what can happen when prices rise too high, too fast and the bubble finally pops. Plus, why it’s so tricky to spot a bubble before it bursts.

After you listen to the episode, here are some questions and conversation starters you can use with your kid listener to see how much they learned about bubbles.

Have you ever experienced FOMO (Fear of Missing Out) or wanted something just because everyone else had it?

What are examples in history when too many people paid way too much money for something and caused a bubble?

If you could build your own treehouse, what would it look like?

Would you rather have a piggy bank that grows your money slowly, or a magic wallet that gives you a surprise amount of money once a year?

*Bonus* Not-So-Random Question: What’s the most valuable thing you own and why?

For listeners who want to keep learning more about the housing market and economic bubbles, here are some ideas:

Listen to this “Million Bazillion” episode to learn more about the difference between renting and buying a house.

Then, check out our episode about recessions and depressions.

Want to know more about interest rates? We got you covered with this “Million Bazillion” episode about credit cards.

Click here to read about some of the more bizarre bubbles through history.

Thanks for listening to this episode! Has your kiddo ever seen a $2 bill? Maybe they got one for their birthday? Found one or even spent it on something cool?

We’re collecting stories from our kid listeners about these rare bills. Record your Million Bazillionaire and send the audio using this online form and we just might include your kid in an upcoming episode! We can’t wait to hear what they have to say.

This episode is sponsored by Greenlight. Sign up for Greenlight today at greenlight.com/million.

Note: Marketplace podcasts are meant to be heard, with emphasis, tone and audio elements a transcript can’t capture. Scripts may contain errors. Please check the corresponding audio before quoting it

BUBBLE TROUBLE

Cold Open:

(SFX: ELEMENTARY SCHOOL AMBI, KIDS YELLING IN DISTANCE)

BRIDGET: Hey, Ryan. Are you ready for our big presentation to the 5th grade class today?

RYAN: Yeah, just organizing my notes. And, look- to entertain and thrill the kids, I brought an old classic, a bottle of bubbles! (BLOWS) SFX BUBBLE POP See? Bubbles! Wooo!

BRIDGET: Um, not to be rude, but I don’t think today’s 10 year-olds are gonna be impressed by bubbles you blow from a little plastic wand. You gotta go bigger. Like this bubble blaster.

(SFX: MOTORIZED BLASTER SOUND)

BRIDGET: (LOUDER, OVER MACHINE) This thing can blast seventy bubbles a second.

RYAN: Oh, wow, cool, yeah. But that’s not as cool as this (STRAINING) industrial strength bubble generator I also brought along today.

SFX: HEAVY OBJECT BEING SET DOWN

(SFX: EVEN LOUDER MACHINE)

SFX: BUBBLE POP SFX FROM EARLIER

RYAN: (LOUDER OVER MACHINE) This is the same machine they use for Broadway shows that take place underwater. Like Spongebob. And… Chicago.

BRIDGET: Oh, that’s neat. But not as neat as this giant, human-sized bubble hoop. It’s the circumference of a jumbo-sized hula hoop. And when I stand inside it, it can create a bubble big enough to envelope my whole body.

(SFX: LOW PITCHED BUBBLING SOUND)

BRIDGET: (INDECIPHERABLE, FROM INSIDE BUBBLE) Looks like I win!

RYAN: What? I can’t hear you from inside your bubble.

BRIDGET: (INDECIPHERABLE, FROM INSIDE BUBBLE) I said, looks like I win!

RYAN: Hold on, I gotta pop it to understand you!

(SFX: LOUD POP SOUND WITH SPLASH OF BUBBLE SOAP EVERYWHERE)

BRIDGET: I said, looks like I win.

–Theme Music–

SFX: SCHOOL BELL

(SFX: KIDS FILING INTO AUDITORIUM, GETTING SETTLED)

BRIDGET: Come on in, have a seat, kids. We’ve got this whole auditorium to fill! Welcome to Million Bazillion. I’m Bridget!

RYAN: I’m Ryan! And We Help Dollars Make More Sense… That line sometimes gets a laugh, but usually not. I’m not gonna let your silence throw me. I’m a professional, let’s forget it and move on.

BRIDGET: So do any of you kids have a money question you’d like answered? We’ve got some microphones in the aisles, ready for you to use, don’t be shy!

JOCELIN: “Hi, my name’s Jocelin, my question is: what is the housing bubble and what caused it?”

RYAN: Great question, Jocelin.

(SFX: DRAMATIC STING)

BRIDGET: (DARKLY) Uh, yes. The U.S. Housing Bubble of the early 2000s. . A fascinating, even… heartbreaking subject.

RYAN: (BEAT) Everything ok, Bridget?

BRIDGET: (COMING TO) Uh, yeah! Bubbles, which we’re totally prepared to discuss today since we brought a whole bunch of bubbles to this presentation, by coincidence of course.

RYAN: Yes, interesting how that tends to happen in these episodes.

(MUSIC: EXPLAINER MUSIC)

BRIDGET: To understand housing bubbles, let’s first talk about bubbles - uh, you’re talking about money bubbles, right? Not the soapy ones Ryan is blowing?

CLASSROOM TOGETHER: Yeah!

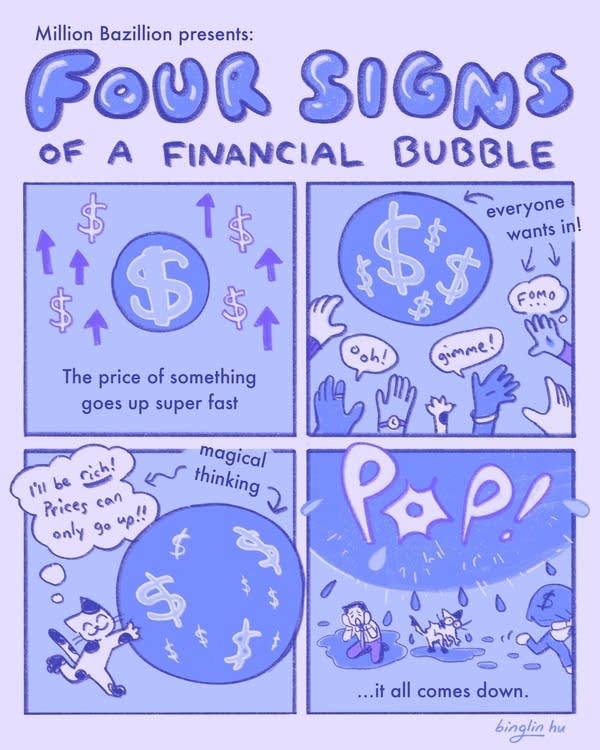

BRIDGET: Okay well, money bubbles aren’t super common. They happen only when the price of something gets way higher than what it should really be worth, or its value.

RYAN: Isn’t…value… or what something is worth… the same as the price?

BRIDGET: Not always.. Because sometimes people can be convinced to pay more for something than what it’s worth.

KID 1: Not me!

BRIDGET: Well, we’d all like to think so! But if you think you’ve found something that’s gonna be BIG, and the price is going to KEEP going up, and you can maybe sell that thing later on for even MORE money…you might be convinced to over pay.

RYAN: Oh yes, the classic “buy high, sell higher.”

BRIDGET: Right. Let me start blowing into this bubble wand. [BLOWS] I’m adding air AND excitement for this new money making idea!

(SFX: LARGE BUBBLE BUBBLING + SFX FROM EARLIER, OUR BUBBLE NOISE)

RYAN: Excitement builds and maybe everyone thinks, the price will never come down. Sometimes it’s not even clear WHY people all want to buy something at once. Like childhood, it’s a glorious time of irrational exuberance.

BRIDGET: Right but then, if it’s a bubble, the problem is, people eventually realize, [OVERWROUGHT] wait, maybe this thing is NOT worth the high price after all. Maybe I can’t sell this for more than I paid. Maybe I won’t make any money at all! This fear becomes a sort of self fulfilling prophecy.

RYAN: [DRAMATICALLY] Watch the bubbles start to fall to the auditorium floor! It’s a metaphor!

BRIDGET: Prices stop rising, people try to sell for cheap to recoup some of their money…and the price craters. The bubble pops. And if you’re one of the last people to jump into the bubble and you paid this really high price for something that suddenly everyone thinks is…worthless, you might kinda feel like you’re the one holding the hot potato when the music stops.

(MUSIC: END EXPLAINER MUSIC SUDDENLY)

KID 2: So, how do you know if you’re in a bubble?

BRIDGET: Well that’s the tricky part. It can be tough to tell you’re in a bubble until it pops–

RYAN: Pops! Because people changed their minds about it, or because someone made it pop! .

(SFX: BUBBLE POP, SPLASHING OF SOAP)

(SFX: KIDS YELL/GROAN)

RYAN: Sorry! I was just trying to illustrate the bubble lesson!

KID 2: You got bubble soap on my iPad!

RYAN: You kids shouldn’t have iPads in school anyway! When I was in your grade, we weren’t even allowed calculators!

BRIDGET: Ok, we have to pause to wipe up all this bubble solution, but we’ll learn more about bubbles of all kinds… when we come back.

–ARK–

KIMBERLY: And now … it’s time for Asking Random Kids Not-So-Random Questions … Today’s question is: What’s the most valuable thing you own and why?

--

Most valuable thing I own is Chippy, because he's an adorable, cute hamster who is so small and looks like a chipmunk, and I want a chipmunk.

In value to my heart, I would say, most of my stuffed animals because I really love them.

My Barbie Dream House, cause it's pink and that's my favorite color.

My Charizard card because it's worth like $300

The most valuable thing i own is my stuffies Peggy and Draggy because i love them and there were my mom’s stuffies.

My house, because it costs a lot of money.

KIMBERLY: That was …

John in New Jersey

Sage in New Hampshire

Camila and Coralie in California.

Livia and Damian in Illinois

This has been Asking Random Kids Not-So-Random Questions.

Part 1:

RYAN: And we’re back. On today’s Million Bazillion, we’re teaching a fifth grade classroom, all about bubbles- and not the chimpanzee, rather the economic phenomenon where people buy too much of something for too long at too high of a price…

BRIDGET: … then the bubble…

KID 1: Yeah, yeah, yeah. The bubble bursts. I think we get the basic idea of a bubble by now. We’re 10, not 2. But we got a question- why do bubbles happen?

RYAN: Well, this is a great question. And the answer is… we don’t know.

SFX: BRASSY MUSICAL STING

BRIDGET: No, Ryan’s right. Economists fight over bubbles all the time and they’d love more research into this. Because when a bubble pops, -some people realize they’re unprepared, which they might learn…

(SFX: DRAMATIC STING)

BRIDGET: The hard way.

RYAN: Uhhh, Bridget, everything ok?

BRIDGET: Uhh, yep. All good. Just drifted off for a minute.

EXPLAINER MUSIC

RYAN: Anyway, there are still warning signs you’re in a bubble. People are buying something because they can sell it at a higher price later, not because they want it for themselves. There’s a limited supply of something, but maybe not for a good reason. Prices start to go up and no one’s sure why. There’s a bunch of hype about something, again, not clear why. There’s a sense of FOMO, a fear of missing out, if you don’t invest now, at any price!

KID 3: What does “invest” mean?

BRIDGET: Oh - Investing is when you put money into some sort of idea or plan that is meant to grow that money. You want to make more than what you put in, over a period of time.

You know, there’s really so much to say about bubbles before we even get to the housing bubble. Let’s not get into the housing bubble just right now.

RYAN: Ok? But… why not?

BRIDGET: In fact, let’s flash back to an example before the housing bubble. Before any of us remember…

(MUSIC: BAROQUE CLASSICAL)

BRIDGET: Back in the year 1636, the Dutch suddenly got super rich and for reasons I am not totally clear on, they got really into Tulips!

KID 3: Tulips like the flower?

SFX: BUBBLE BLOWING POPS FROM START OF EP

BRIDGET: Exactly! It became all the rage to grow really exotic ones. People started buying tulip bulbs, and get this, they weren’t even planting them, they were selling them to OTHER people who bought them only to sell them to OTHER people for even MORE money. Suddenly the price of tulip bulbs was going up 12x what it had been. Some people paid hundreds of guilders for a mere flower.

RYAN: And how much was a hundred guilders back then? Wait, how much was one guilder?

BRIDGET: I dunno. But a hundred guilders was a ton. Turns out tulip-mania was short-lived, when- you guessed it, the tulip market crashed and the bubble-

ENTIRE CLASS: Burst.

KID 1: Right right, so that’s how that bubble worked. Now what about that Housing Bubble you were talking about?

BRIDGET: Yeah, I just don’t know if you’re REALLY getting what a bubble is yet,, let’s talk about another classic example…the Beanie Baby bubble!

(MUSIC: ‘90s POP TRACK)

BRIDGET You remember having Beanie Babies, right?

RYAN: (TISKS) That wasn’t really my scene, Bridget.

BRIDGET: Well, I had some Beanie Babies. Think Labubus, but cute! They were little beanbag stuffie toys with the trademark Heart tag in their ear. There were even some special edition ones, which some people mistakenly thought were only available in limited quantities. People were convinced that collectors would pay top dollar for those ones. Like collector edition toys or baseball cards.

SFX: BUBBLE BLOWING POPS FROM START OF EP

RYAN: But the problem with Beanie Babies was, like a lot of popular toys, so many of them were made and sold, there was no rarity- or scarcity- to drive up the value. They were just strangely understuffed animals you could find everywhere- in half of American households, in fact. Though not in mine. I was more into Star Wars action figures. I still have a Jar Jar mint in box. I think its value will explode any day now.

BRIDGET: Then when people started to question the value of Beanie Babies as(and) if they were really all that rare, and who would want them in the future, surprise, surprise- the bubble burst.

(SFX: BUBBLE POP)

KID 2: So, what about the housing bubble??

RYAN: Yes, perfect segway, in to the housing bubble-

BRIDGET: Wait, wait, wait, let’s do another example from history because I don’t think you guys really GET this bubble thing…

RYAN: Bridget, I get the feeling you’re stalling for some reason.

BRIDGET: But this is a really fun example from the year 2000!

RYAN: (HIGH PITCHED) In the year 2000…

(MUSIC: BOY BAND-TYPE BEAT)

SFX: BUBBLE BLOWING POPS FROM START OF EP

BRIDGET: It was around the turn of the millennium and people were really excited about this hot new high tech thing…buying stuff online. . Everyone wanted to invest in new internet companies, or startups as they’re called, thinking it would be their ticket to outrageous fortune. They thought every idea was a sure winner!

RYAN: One of those ideas was a website called Pets.com. It basically sold pet supplies- like doggy chew toys and cat litterboxes.

(SFX: PETS BARKING AND MEOWING)

BRIDGET: Did you buy Skimbelshanks’s cat supplies from there?

RYAN: Oh no, this was all long before Skimbelshanks- and most of our listeners- were even born. Pets.com got a bunch of money from investors. They were rolling in it!

RYAN: And Pets.com was in deep! In fact, rolling in that VC money, they started to build up excitement by running a ton of commercials on tv with this sock puppet dog mascot They used some of that cash to run a ton of commercials on TV with this sock puppet dog mascot.

(CLIP: PETS.COM COMMERICIAL A medley of Pets.com TV Commercials)

RYAN: You have to remember, it was the year 2000. Everyone was entertained more easily, so people sorta liked the puppet.

[EXPLAINER MUSIC OR BOY BAND MUSIC FROM ABOVE]

BRIDGET: The problem is- Pets.com spent so much money on those commercials, and also on shipping costs…but they never figured out how to actually make a profit. People were still buying pet food the old fashion way, at the store, or from other online pet food companies, like Pet Smart. Eventually a bunch of investors got tired waiting for Pets dot com to succeed. They stopped investing their money. And this happened to a bunch of other internet companies around the same time. Basically investors realized that not EVERY idea was going to work. And this led to the burst of the dotcom bubble.

(SFX: BUBBLE BURST)

BRIDGET: See kids, a bubble is kinda like this…Have you ever realized a good idea isn’t such a good idea after all? Then you change your mind?

RYAN: And unlike online shopping today, where you can usually change your mind within 30 day for a full refund, no harm no foul, when people change their mind about the future worth of something…let’s just say there’s gonna be consequences.

KID 1: Hey, I think we get it. Bubbles exist and then they burst.

BRIDGET: Well, good then. Seems like we needn’t provide another example. It’s been lovely speaking to your class today.

(MUSIC: MILLION BAZILLION THEME)

BRIDGET: This has been Million Bazillion, be sure to check us out wherever you get your podcasts-

SFX RECORD SCRATCH

RYAN: Wait, wait! We didn’t really get to the main part of Jocelin’s question, which was about the housing bubble of 2008.

BRIDGET: Did you say the stock market crash of 1929? Cause that’s also a good example.

(MUSIC: 1920s JAZZ)

BRIDGET: The 20s had been a-roarin’ with jazz and flappers, when someone had the idea to start buying stocks with borrowed money. A bubble loomed in the stock market-

(CUT JAZZ MUSIC ABRUPTLY)

RYAN: No! I’m not talking about the 1920s. I’m talking about the housing bubble, which was particularly devastating because a house is the single biggest purchase most people make in their lives, and when their value starts going down, that's a major problem for the whole economy. So let’s do it, let’s get into housing bubbles.

BRIDGET: (PAINED) Really? Do we have to?

RYAN: Yeah, why don’t you want to talk about the housing bubble?

BRIDGET: (SIGH) Because… I… was personally affected by the housing bubble of the early 2000s, ok!

(SFX: SOME GASPS IN THE CLASS)

BRIDGET: There I said it. That’s why I was trying to avoid talking about it today. It’s an embarrassing story that I don’t like to bring up.

RYAN: Really? You? But, Bridget, you’re the most financially responsible person I know. How did you get caught up in spending too much on a house?

BRIDGET: A lot of people did back then! It’s a long story! And I guess to really teach this class about housing bubbles, I need to finally tell it. So here goes… It all began back in…

(MUSIC: HARP GLISSANDO)

RYAN: Oh, wait, so sorry, before you get into it, we gotta take a quick break, but I promise when we come back, we’ll hear Bridget’s housing bubble story, right after this!

MIDROLL -

Part 2:

RYAN: Welcome back to Million Bazillion. Today, we’re speaking to a classroom of kids all about housing bubbles and Bridget was about to launch into a very dramatic story. So now that we’re back, the floor is all yours. Go on.

BRIDGET: Ok, so like I was saying, my housing bubble story all began back in 2006.

(MUSIC: HARP GLISSANDO)

BRIDGET: I was just a high school kid, walking home from school one day, when I saw a “For Sale” sign that piqued my interest.

(SFX: OUTDOOR COUNTRY AMBI)

TEEN BRIDGET: Excuse me, I’m curious about the “For Sale” sign in your yard.

TREE HOUSE LADY: Oh really? The one in front of the tree house, eh? You’re in the market for a tree house?

TEEN BRIDGET: Yeah. I’ve never had a tree house of my own and I’m wondering how much you’re asking for this one. It looks very clean, it’s in an awfully tall tree, in a nice yard.

TREE HOUSE LADY: Oh yes, it’s a special treehouse indeed. I built it for my kids years ago, but they’re all grown up and not interested in playing in it anymore. (RESENTFUL) Too busy with their “jobs” and “spouses”, I guess.

TEEN BRIDGET: Hmmm, and to be clear, you’re just selling the tree house, right? Not your regular house?

TREE HOUSE LADY: Yep, just the tree house. You can buy it and go in it whenever you want, for two-thousand dollars.

TEEN BRIDGET: (SIGHS) I don’t have two-thousand dollars. Guess I can’t buy this treehouse.

TREE HOUSE LADY: Oh well, maybe one day you will. Never give up hope. You take care now. Bye bye.

(SFX: RECORD SCRATCH)

RYAN: Wait, wait, wait, your housing bubble story is about buying a tree house?

BRIDGET: Yeah, what’s the problem? The TREE house bubble. Which incidentally, exactly mirrors the NON-Tree house bubble of the early oughts. ,

KID 2: Let her keep telling the story! Bridget, go on.

BRIDGET: Thanks, kid. Ok, so anyway, I may not have had two-thousand dollars. But even at that young age, I had enough financial acumen to know sometimes adults buy things they can't afford all of at once. So I went to my local bank to look into getting a loan.

(MUSIC: HARP GLISSANDO)

[SFX BANK AMBI]

LOAN OFFICER: Welcome to First Bank of Kalamazoo, Ms. Bodnar. I’m the chief loan officer here. I’ve looked over your application and I just want to confirm a few things. Do you have any money saved?

TEEN BRIDGET: Um, no. Oh wait! I have the last ten dollars of my tooth fairy money saved. I spent most of it on horse magazines years ago, but saved ten dollars for a rainy day fund.

LOAN OFFICER: And you have no history of credit, right?

TEEN BRIDGET: Um, no. That’s like the stuff you get when you prove you can spend money responsibly, right?

LOAN OFFICER: Right.

TEEN BRIDGET: Then no.

LOAN OFFICER: What about a job? Any current employment?

TEEN BRIDGET: I babysit in the summer. But during the school year, I like to stay focused on my studies, so currently unemployed.

LOAN OFFICER: And you’re asking this bank for a two-thousand dollar mortgage for a tree house? Ummm kay. Well, looking over all your financials, I must tell you-

TEEN BRDIGET: Sorry, I know it was silly of me to come down here thinking I could borrow money. I’ll show myself out.

LOAN OFFICER: I must tell you, we’d be happy to give you a loan.

TEEN BRIDGET: Wait. What? But I don’t have any income or job or savings and I’m fifteen. Aren’t I kind of a bad candidate for a loan?

LOAN OFFICER: Oh, you’re a very bad candidate. You’re what we call in the loan business, a subprime borrower. Basically you’re not our first choice to lend money too, because you have no credit, or very bad credit. But you’re also what we call… lucky, because right now our bank isn’t too worried about that.

TEEN BRIDGET: What? Why?

LOAN OFFICER: I don’t know if you know this, but the tree house market is on fire right now. Everyone’s buying and the prices keep going up. It just doesn’t feel that risky to give someone money to buy one. Like even if you couldn’t pay back your loan, you’d be able to sell your tree house to someone else for more than what you paid, easy. We don’t think this tree-housing boom is ever gonna slow down.

(SFX: RUBBER STAMP)

LOAN OFFICER: Your loan is approved. You’re all good. You want a free pen? Or better yet, can I interest you in a loan for a real house?

TEEN BRIDGET: What?

LOAN OFFICER: Yeah, we’re giving them out pretty willy-nilly at the moment.

TEEN BRIDGET: Uhhh, no thanks. Not today.

(MUSIC: HARP GLISSANDO)

BRIDGET: And like that, I had a mortgage, and the money I needed to buy my dream treehouse.

RYAN: But I don’t get it. How did the housing bubble get you in hot water over one little treehouse?

BRIDGET: Unfortunately, this story doesn’t stop at one little treehouse.

(MUSIC: HARP GLISSANDO)

(SFX: HAMMERING NAILS INTO WOOD)

TIFFANY: Hey, Bridget! Cool treehouse!

TEEN BRIDGET: Oh, hi Tiffany.

TIFFANY: How did you afford it? No offense, but you’re just a jobless high school kid like the rest of us.

TEEN BRIDGET: I got a mortgage from the bank. It was surprisingly easy. I just went down and asked and they gave me one even though they knew I had no reliable income!

(SFX: HAMMERING NAILS INTO WOOD)

TIFFANY: Ya don’t say, eh? What are you doing up there?

TEEN BRIDGET: Home improvements. I took out a second mortgage to build a sunroom onto my treehouse. It’s a shame to miss out on the morning light. It’s so good for serotonin production, regulating circadian rhythm-

TIFFANY: Hey, can I get the number of the loan officer who lent you that money?

TEEN BRIDGET: Sure thing, I have it around here somewhere. Why don’t you come up and we’ll drink tea out of my little plastic tea set while I find the number?

TIFFANY: You betcha!

(SFX: SCORING BUILDING TENSION)

BRIDGET: In the weeks that followed, all my friends went down to the bank to get treehouse mortgages of their own.

(SFX: COMMOTION INSIDE THE BANK)

BRIDGET: It was almost like a treehouse frenzy spread over the town. Everyone had “tree house fever.” Everyone wanted a treehouse of their own and treehouse sellers could ask for more and more money. Competition to buy was fierce!

(MUSIC: HARP GLISSANDO)

(SFX: OPENING MAIL)

BRIDGET: Yeesh, another statement saying that the value of my treehouse has gone up. That’s the third one this month.

SFX: HUBBUB

PASSERBY #1: (DISTANT) Hey, is your treehouse for sale, by any chance?

BRIDGET: Uh, no, it’s not on the market.

PASSERBY #1: I’ll give you five thousand dollars for it.

PASSERBY #2: I’ll give you ten thousand dollars!

BRIDGET TO SELF: Wow, I only paid $2,000 for this tree house! It turned out to be a great investment!

PRESENT DAY BRIDGET: This is, by the way, how a bubble takes off. People feel like they’ve missed out on this great opportunity to make money and they’re desperate to get in on it, even if they have to pay a little more.

TIFFANY: (EFFETE) Sorry, boys! You should’ve gotten in on the ground floor months ago.

BRIDGET: Tiffany! How are you? How’s your tree house?

TIFFANY: Houses, darling. You must visit our summer tree house this July. We’ve installed a watermill like in Swiss Family Robinson.

TEEN BRIDGET: Only if you promise to spend Christmas at my treehouse. I’ve put in a chimney, specifically for Santa.

TIFFANY: (LAUGHS) Absolutely fabulous!

(MUSIX: HARP GLISSANDO)

BRIDGET: A lot of people bought more than one treehouse.

RYAN: But not you, Bridget? You were responsible and just bought the one and paid it off fully, right?... Right?

BRIDGET: Uhhhhh. Not exactly. At the height of the treehousing bubble, I owned… seven treehouses.

RYAN: Seven treehouses?

BRIDGET: I said it was an embarrassing story! But you gotta remember, this was 2007! Obama was running! Michael Clayton was in theaters!

KID 3: Rihanna’s Umbrella was topping the Billboard charts, Ryan!

RYAN: Ok! Ok!

BRIDGET: We were all on a high- from the never-ending economic growth of the treehouse sector, and literally up high in our treehouses. I thought I could buy a bunch of tree houses, gussy them up, and then sell them again for even more than I paid and make a nice tidy profit! So I took out another mortgage against the value of my tree house.

RYAN: You did what now?

BRIDGET: That means I used my first tree house as my promise to the bank that I’d pay back a loan for a second tree house. Then I took out another loan using my second tree house as the promise I’d pay back this new loan. And did it all again. I thought, prices will never go down! I can’t lose! But then came the first signs of the crash to come…

(MUSIC: HARP GLISSANDO)

(SFX: OPENING LETTER)

(MUSIC: SUSPENSEFUL MUSIC AS BRIDGET SPINS OUT)

TEEN BRIDGET: Whoa whoa whoa, what’s this about my interest rate? That’s the extra money I pay every month on top of what I’m already paying back on my loan. It looks like it’s…going up? So this means I have to start paying more money every month. I can’t afford that! Plus, I’m out of baby teeth, so the tooth fairy money has dried up. Wait a second. If interest rates are going up, that might mean fewer people want to take out loans to buy tree houses, which might make it harder to sell my extra tree houses….Ooh, boy, uh [increased panic] I’m starting feel like things could very quickly go bad for me here, uh, I’m getting this feeling like I’m underwater, and I’m going to start uh, drowning in debt??

TEEN BRIDGET: Hmmm, I think I need to talk to my loan officer about this one.

(MUSIC: QUICK TRANSITIONAL STING)

LOAN OFFICER: Yeah, sorry about that. Turns out you agreed to a loan with an adjustable interest rate, which basically means we can charge you more money for borrowing money whenever we want. And right now, we want. Last month, Treehouse prices just dropped. Suddenly people are asking questions about all these high priced mortgages we’ve been giving out and we need to start bringing in more money, build up a cushion of reserve cash. But don’t worry, it’s not just you. We’re raising interest rates on everyone.

TEEN BRIDGET: But what if a bunch of those people can’t pay back their treehouse loans now that the monthly payments have gotten so high?

LOAN OFFICER: Then I guess that would mean we start repossessing those treehouses.

TEEN BRIDGET: Repossess…that means you’re going to take my treehouses away from me! Because I used them as my promise to pay back my loan!

LOAN OFFICER: And if a lot of people can’t pay their mortgages all at once, we start repossessing a LOT of treehouses. And we’re not a landlord, so we’d try to put those treehouses back on the market. Which might mean a flood of treehouses all at once, driving all the prices down. Uh, yeah, that would be … pretty bad. Very bad, even.

TEEN BRIDGET: Really? A housing bubble that turned into a housing crash couldn’t like, bring down the whole economy right? It couldn’t cause a recession?

LOAN OFFICER: Well, bubbles don’t usually sink the entire economy. But, in the case of the housing market, at this exact moment in time, banks like ours have so much money tied up in them.. if it fails, we’re in serious trouble. Excuse me, I gotta, uh… I gotta make some phone calls.

(SFX: PHONE DIALING)

LOAN OFFICER: Hey, Mike. It’s Larry. It’s urgent. Yeah, did we lend out ALL our money to treehouse mortgages? We kept SOME of it back, right? [UNINTELLIGIBLE MIKE MURMER] Not even some for groceries? (DUCK UNDER BRIDGET’S LINE)

BRIDGET: And like that, our treehouse of cards started to fall…

(MUSIC: BAROQUE CHORUS. REFERENCE: St. Matthew Passion, BWV 244 - Chorus: 'Wir setzen uns mit Tränen nieder' by Bach)

BRIDGET: In 2008, it wasn’t just the tree house market that crashed. The housing bubble that had been expanding for years eventually got too thin, and burst.

(SFX: GIANT BOMB SOUND)

BRIDGET: And the result was really scary for a lot of people. There were mass foreclosures- a foreclosure is when a money lender like a bank takes back the house from the borrower and now owns it for themselves. There was a global credit freeze, making it harder for people to borrow money. Not to mention a Great Recession, which, well- if you want to know more about recessions, check our episode on them from Season 5, episode 2. All I remember from 2008 was me and my friends being scared. It was like the rope ladder had been pulled up and we couldn’t climb up any further, metaphorically-speaking. This was the bad time.

TIFFANY: Bridget, I had to sell my summer treehouse! And my winter treehouse! And my fall and spring treehouses! And the treehouse where I spend leap day once every five years! Gone! All gone!

BRIDGET: My friends and I lost our treehouses and it would be a long time before we’d be able to borrow that kinda money again. Our credit ratings were in tatters and we owed a lot of debt without anything to show for it. It had been a glorious time while it lasted, but it had finally come to an end.

(END MUSIC)

(SFX: WIND SWEEPING THROUGH FOLIAGE)

BRIDGET: I sold off all my treehouse properties, including the first one I ever bought. Years later, I visited the site of that treehouse, which was now overrun with squirrels.

(SFX: SQUIRRELS)

BRIDGET: The squirrels were a messy, but cute bunch. They even used my old tea set, which I thought was pretty cool.

(SFX: SQUIRRELS SQUEAKING AND DRINKING TEA)

BRIDGET: And with that, the bubble had burst.

- MINI SEGMENT- Would you rather have a piggy bank that grows your money slowly or a magic wallet that gives you a surprise amount of money once a year?

Part 3:

BRIDGET: Welp, that’s my tale of how I got caught up in the housing bubble.

KID 2: Wow, Bridget. What a story. 2008 sounds like a wild time. What were you doing in 2008, Ryan?

RYAN: Eh, mostly watching fail videos on YouTube. Ok, well why don’t you explain what we learned about bubbles today, while I try to break the record of world’s biggest bubble, with this super-sized bubble ring!

(SFX: BIG WOBBLY BUBBLE INFLATION SOUND)

BRIDGET: Okay so, bubbles are when people get excited and convince themselves to pay more for something than its worth, because they believe the price is going to go up in the future. It’s really hard to know you’re in a bubble and even the smartest economists admit there’s a lot they don’t know. There really was a housing bubble in the United States. It started when banks made it a little too easy to get a home loan, people didn’t think prices would ever go down, and then home builders started building more homes than people needed, trying to get in on the frenzy. The collapse of that bubble kicked off a financial crisis in 2008 followed by a recession. A lot of families took years to recover from it. But it inspired many countries, including ours, to pass new laws and regulations to stop it from happening again in the future.

RYAN: Great recap, Bridget. And thanks for sharing your story. Though it may be embarrassing for you, it’s important to learn from mistakes like this.Well kids, I hope you enjoyed our presentation. If you like our show, leave us a comment, and not just a spot the difference comment, but like a real comment-

(SFX: LOW-PITCHED BUBBLE SOUNDS)

RYAN: What’s that sound?

BRIDGET: Oh my gosh… look outside the window… This entire auditorium is in a… GIANT BUBBLE.

(MUSIC: ACTION MOVIE MUSIC)

(SFX: KIDS IN CLASSROOM YELPING)

KID 1: And we’re floating into the air!

BRIDGET: (SING SONGY) Defying gravity!

RYAN: How did we end up in this bubble?!?

BRIDGET: Probably from one of those giant bubble blowers we brought! Like we keep saying, it’s impossible to know if you’re in a bubble until it pops!

KID 1: I’m gonna try to pop it!

BRIDGET: No! That’s dangerous!

KID 1: (TOUGH) It’s dangerous, but somebody’s gotta do it!

(SFX: GIANT BUBBLE POP)

(SFX: CLASSROOM CRASHES BACK DOWN)

(SFX: EVERYONE SIGHS IN RELIEF)

RYAN: Ok, I’ll admit it- I might’ve blown that bubble a bit too big.

–Theme Music-

BRIDGET: That’s all for this episode of Million Bazillion! Thanks for sticking with us to the very end.

RYAN: If you STILL have questions, or an idea for an episode, send them to us at Marketplace dot org slash million.

BRIDGET: While you’re there, sign up for our newsletter. It’s better than those other newsletters out there because we send you new Million Bazillion episodes AS they’re released along with a tipsheet. That tipsheet is gonna give you a bunch of fun conversation starters and more ways to learn about the money question of the day -even after the episode ends!

RYAN: Million Bazillion is produced by Marketplace from American Public Media. I, Ryan Perez wrote and hosted this episode along with Bridget Bodnar.

BRIDGET: Our senior producer is Marissa Cabrera. Our editor is Jasmine Romero. Additional voicing from: Amy Scott, Drew Jostad, Alice Wilder, Jesson Dueller, Iru [ee-roo] Ekpunobi [Eck-puh-NO-bee] … August, Felicity and Andy

RYAN: Flora Warshaw helped produce this episode.

It was sound designed by Sam Bair

And mixed by Derek Ramirez.

Our theme music was created by Wonderly.

BRIDGET: Special thanks to Francesca Levy and Daryl Fairweather, chief economist at Redfin, who helped us answer today’s question

RYAN: Bridget Bodnar is the Director of Podcasts at Marketplace.

Joanne Griffith is the Chief Content Officer

Neal Scarbrough is the VP and General Manager.

BRIDGET: Million Bazillion is funded in part by the Sy Syms Foundation, partnering with organizations and people working for a better and more just future since 1985. And special thanks to The Ranzetta Family Charitable Fund and Next Gen Personal Finance for providing the start-up funding for this podcast, and continuing to support Marketplace in our work to make younger audiences smarter about the economy.

RYAN: If Million Bazillion is helping your family have important conversations about money, consider making a one-time donation today at marketplace-dot-org-slash-givemillion, and thanks for your support.

The Ranzetta Family Charitable Fund and Next Gen Personal Finance, supports Marketplace’s work to make younger audiences smarter about the economy. Next Gen Personal Finance is a non-profit that believes all students benefit from having a financial education before they cross the stage at high school graduation.

Greenlight is a debit card and money app for kids and teens. Through the Greenlight app, parents can transfer money, automate allowance, manage chores, set flexible spend controls and invest for their kids’ futures (parents can invest on the platform too!) Kids and teens learn to earn, save, spend wisely, give and invest with parental approval. Our mission is to shine a light on the world of money for families and empower parents to raise financially-smart kids. We aim to create a world where every child grows up to be financially healthy and happy. Today, Greenlight serves 5 million+ parents and kids, helping them learn healthy financial habits, collectively save more than $350 million to-date and invest more than $20 million.

The Sy Syms Foundation: Partnering with organizations and people working for a better and more just future since 1985.