12/29/2017: China tries to one up America’s corporate tax cuts

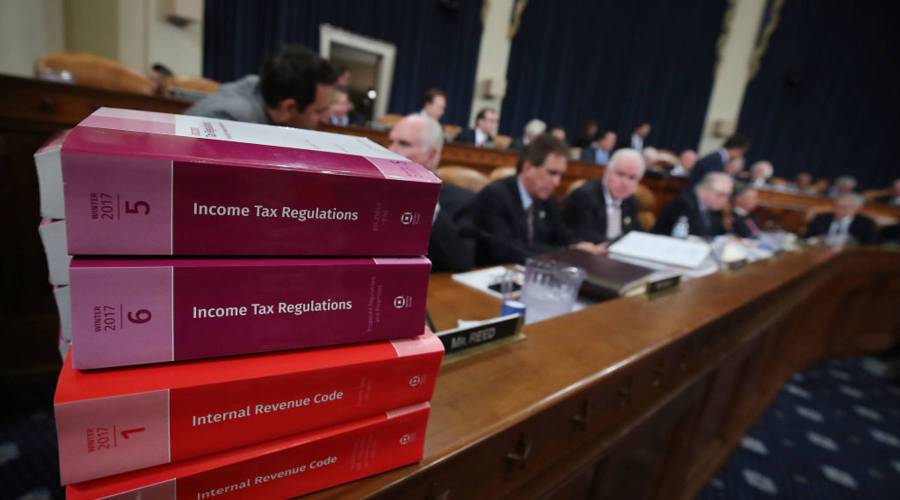

(Markets Edition) The GOP tax overhaul will decrease the corporate tax rate, which proponents of the bill have argued is much lower in other countries. But China recently announced foreign firms will not have to pay taxes on their earnings. We'll examine whether this move will make U.S. companies want to stay in China. Afterwards, we'll discuss the tax bill's effects on Puerto Rico — now income from patents and other intellectual property on the island will be considered foreign income. Then, we'll look at how one Dallas nonprofit is training people who are visually impaired to work with textiles.

(Markets Edition) The GOP tax overhaul will decrease the corporate tax rate, which proponents of the bill have argued is much lower in other countries. But China recently announced foreign firms will not have to pay taxes on their earnings. We’ll examine whether this move will make U.S. companies want to stay in China. Afterwards, we’ll discuss the tax bill’s effects on Puerto Rico — now income from patents and other intellectual property on the island will be considered foreign income. Then, we’ll look at how one Dallas nonprofit is training people who are visually impaired to work with textiles.