As vinyl record sales eclipse CDs, LP pressing plants are thriving

As vinyl record sales eclipse CDs, LP pressing plants are thriving

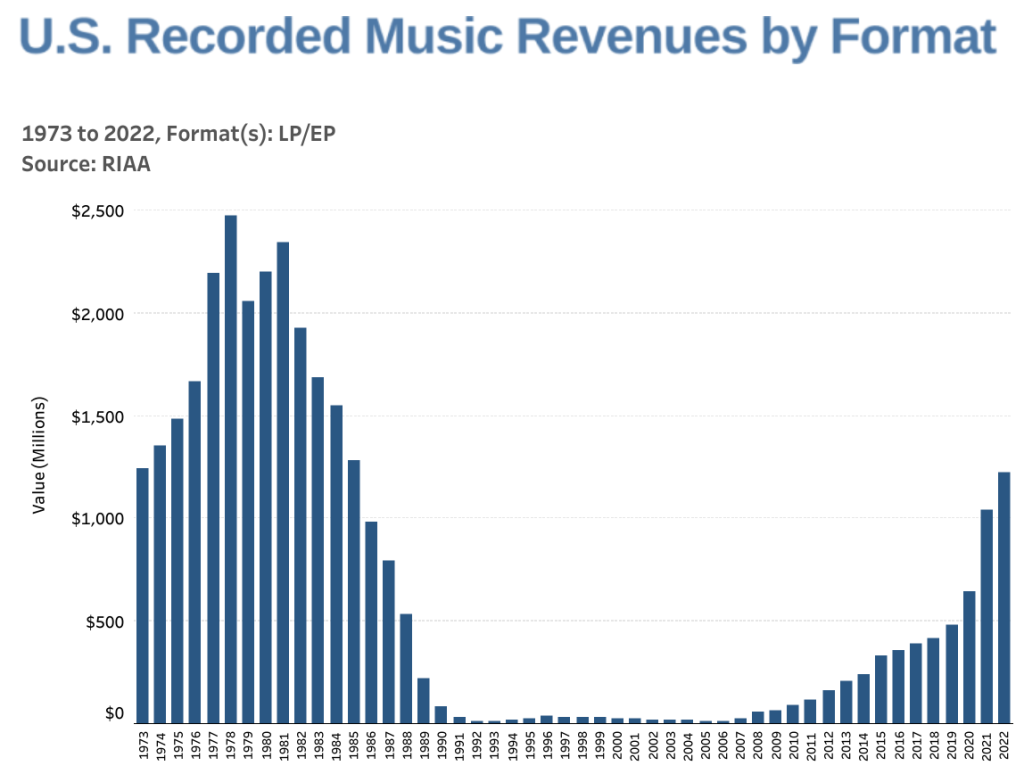

Last year, consumers bought more new vinyl records than CDs. It’s the first time that’s happened since 1987, according to the Recording Industry Association of America.

The LP industry is booming, but for the businesses that manufacture those records, the last few years have been a bumpy ride.

The Burlington Record Plant sits in a narrow industrial building behind a bagel shop in Burlington, Vermont. Inside, a machine that dates back to the 1960s presses vinyl discs, etched with the music of a local soul-folk trio. The press makes one record every minute or so.

“Truthfully, I’m… a boutique pressing plant,” said owner Justin Crowther, who’s operated this small shop since 2014.

Since the vinyl boom started, Crowther said he’s turned down investment offers and orders from major record labels. That makes him something of an outlier as sales of LPs, and the number of plants making them, have exploded.

“It’s great for the business,” Crowther said. “I just hope that it’s not too much too fast.”

The vinyl resurgence started in earnest in the mid-2000s, according to Josh Friedlander, senior vice president of research and economics at the Recording Industry Association of America (RIAA).

“2005, I think, was the year that vinyl sales were actually at their lowest in the U.S.,” he said.

Sales have climbed ever since, driven first by indie labels and small record stores. Then, in the last few years, Adele, Taylor Swift and other major artists joined in, and Target, Wal-Mart and Best Buy started selling reissues of classic albums. Things really took off in the last few years: Between 2020 and 2021, vinyl revenues jumped by over $450 million, according to the RIAA.

But vinyl’s success is relative, Friedlander said. The music industry really makes money through streaming.

“There are trillions of streams, and 80-plus percent of the revenue is still coming from streaming,” he explained.

Still, over the course of the pandemic, vinyl managed to carve out an eight percent slice of industry revenues. But getting there wasn’t easy for pressing plants.

“For the industry, it was just like one hit after another, honestly,” said Jenn D’Eugenio, the founder and president of the industry group Women in Vinyl. “We started the year before the pandemic with the Apollo lacquer fire.”

In February 2020, that fire destroyed Apollo Masters, the only plant in the U.S. that made lacquer discs, a crucial component in the record-making process. Then, the pandemic caused a shortage in polyvinyl chloride (PVC).

“When everybody started to renovate at home and use, you know, vinyl flooring and things like that, because they couldn’t go anywhere, we couldn’t get the PVC that we needed to actually press records,” D’Eugenio said.

Most of those supply chain issues have eased in recent months, according to Dustin Blocker, the owner of Hand Drawn Pressing in Dallas, Texas and the president of the Vinyl Record Manufacturers Association. New record pressing plants have opened, helping to reduce the backlog of orders. Other plants have expanded, including Blocker’s.

“We doubled our production lines, we’ve made huge growths in our staff,” Blocker said. “We run 24 hours, five days a week.”

Meanwhile, two industry leaders, both in Tennessee, have finished or announced multi-million dollar expansions in just the last few weeks.

Blocker thinks that’s great for the industry as a whole, but he worries that as vinyl becomes more mass-produced, the quality of the records themselves could suffer.

“The hard part about a vinyl record, [is] they are uniquely made one at a time,” Blocker said. “They’re wildly different from one another.”

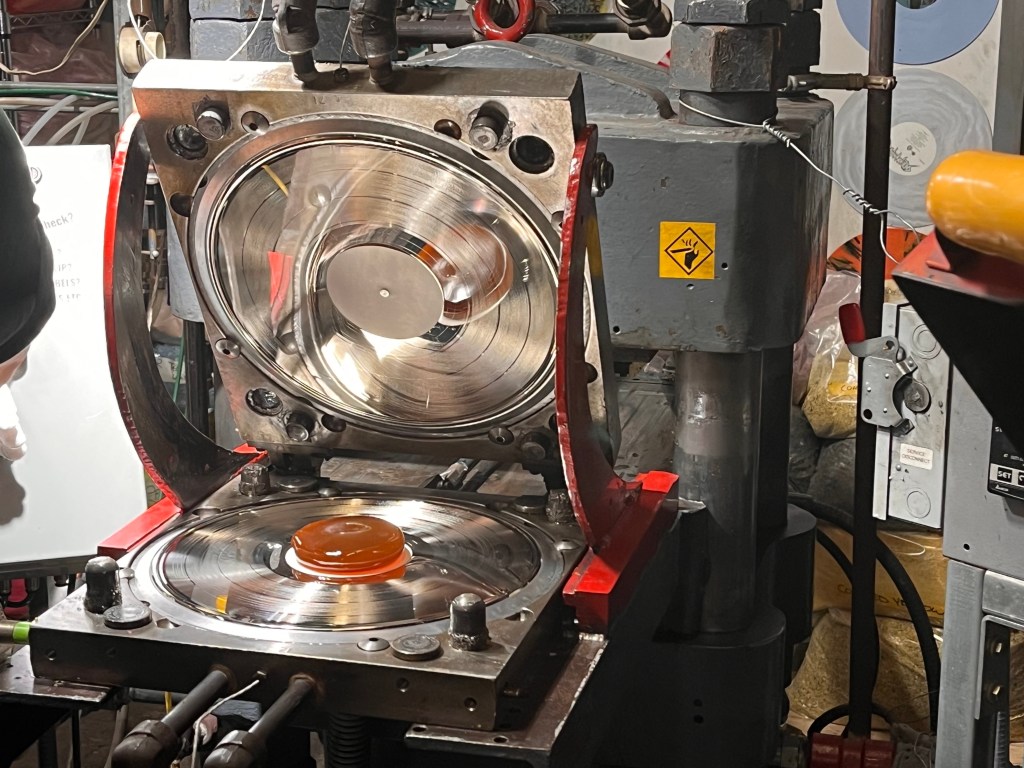

That finicky operation is on display at the Burlington Record Plant, where owner Justin Crowther showed me a glob of hot PVC, about the size of a hockey puck.

“This is what it looks like before you make a record,” he said. “It’s about 300 degrees.”

One of his employees placed the puck on a paper label in between two circular metal plates. The plates are closed, and a minute or so later, out pops an LP. At this shop, all of this is done manually, Crowther said.

“It’s constant work to just keep all eyes and ears on each parameter … and it’s a very difficult process,” he said.

But it’s a process he intends to stick with. Even as more mainstream acts and money pour into the vinyl business, Crowther wants to keep his focus on smaller labels and local artists, the kind of work that brought vinyl back in the first place.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.