Why do teachers pay for school supplies with their own money?

Share Now on:

Why do teachers pay for school supplies with their own money?

This is just one of the stories from our “I’ve Always Wondered” series, where we tackle all of your questions about the world of business, no matter how big or small. Ever wondered if recycling is worth it? Or how store brands stack up against name brands? Check out more from the series here.

Listener Kathy Campbell, who had heard a story about the long list of school supplies that parents have to provide, wrote in with this question:

I don’t remember any of this from the 1950s when I was in school (maybe pencils?), and not anything like so much from the 1980s when my daughter was in school (still mostly pencils?). What’s behind this change, where teachers have to provide hundreds of dollars worth of supplies for their classrooms, too?

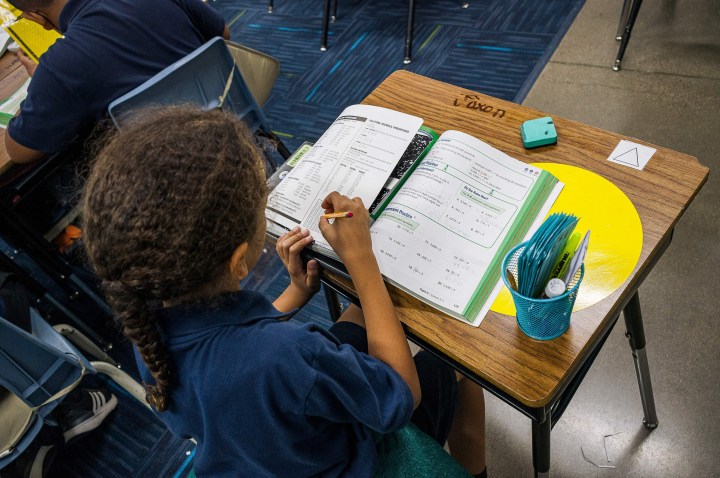

Wendy Threatt, a fourth-grade teacher with the Escondido Union School District in California, has spent as much as $1,000 of her own money on classroom needs during a school year.

Sometimes it’s for supplies, like high-quality paper and books for her classroom library. Other times, it’s for her students’ basic needs — shoes, jackets, even food.

“I have snacks for my students because they’re hungry. Some of them don’t get dinner,” she said.

But to Threatt, this is not going “above and beyond.” It’s the bare minimum needed to ensure her students’ success and well-being.

“I would just like the public to be aware that whenever you walk into a teacher’s classroom,” she said, “that what you’re looking at is their money — their money put toward the education and the success of all those children in that room.”

How much do teachers, and parents, shell out?

Teachers are allowed to deduct up to $300 in out-of-pocket expenses on their taxes, while some schools offer instructors additional funds to help buy extra supplies they need. But many teachers spend far more than the assistance provided to them.

Ninety-four percent of K-12 instructors in public schools spent their own money, without reimbursement, on supplies during the 2014-15 school year, according to the National Center for Education Statistics. The average amount was $478.

A more recent analysis from My eLearning World found that teachers were set to spend more than $820 on classroom supplies — including books, snacks, pencils, paper and cleaning products — during the 2022-23 school year.

Marketplace’s Stephanie Hughes previously reported that inflation has exacerbated the problem, pressuring teachers to either spend more than they usually would, cut back or seek additional help from their school or community. After the pandemic began, inflation climbed to a 40-year high, and school supplies haven’t been immune.

Stacey Lindsey, a Kansas resident who teaches high school seniors, said she gets a small budget for supplies, about $60 a year. But she spends roughly $300 to $500 on items such as Kleenex, snacks and copy paper — and has exceeded that range in some years.

Lindsey, who originally planned to go to law school, entered the teaching profession 30 years ago. “It’s a cliche, but I really felt like I could make a difference,” she said.

Heather Peske, president of the National Council on Teacher Quality, noted that funding provided by schools can vary widely. “Some schools offer a certain amount of money for teachers to use for supplies, and other schools may not offer that,” she said.

Data from the National Center for Education Statistics also shows that teachers spend more at schools in low-income communities.

“Schools that have students who are higher-resourced often supplement school budgets through things like the parent-teacher organization,” Peske said. “And oftentimes, these schools with students from more affluent backgrounds can just simply ask parents to send in supplies.”

But for teachers in districts with higher poverty rates, they often take it upon themselves to make up the difference, she said.

Parents can also feel the burden of having to pay for school supplies. A majority of those with kids younger than 18 felt stressed about having to pay for back-to-school shopping, while about one-third expected to take on debt to afford it, according to a 2022 survey from LendingTree.

In 2021, parents expected to pay almost $500 for back-to-school, although 2022’s survey showed the expected amount had decreased to $409. Parents may have cut back their spending due to inflation or because they had already made big purchases like computers the previous year, according to LendingTree’s analysis.

How has out-of-pocket spending changed?

While teachers are spending more and some districts are worse off than others, those aren’t necessarily signs that overall school funding has decreased.

Marguerite Roza, director of the Edunomics Lab at Georgetown University, explained that the country has actually expanded its per-student investment in public education.

Schools have increased their staffs, so more funds are flowing to those workers. When education unions negotiate, they push for more hiring or they bargain for better salaries and benefits, like retirement programs and health coverage. That leaves less cash for supplies.

“If the priority was $1,000 per teacher for supply money, then that might be $1,000 at the expense of something else,” Roza said.

When education budgets are constrained, funds for school supplies tend to be cut, said Paul Hill, a professor at Arizona State University and founder of the Center on Reinventing Public Education.

“The forces that push for teacher salary increases push for them without limit. And I don’t mean to blame anybody, that’s just the way it goes. No union has ever advocated for less,” Hill said. “You’ve got an advocacy structure that favors teacher salaries over other kinds of expenditures.”

While there’s pressure to boost teacher salaries, that doesn’t mean, at the end of the day, that they’re being paid enough. Hill said the market is telling us that they’re not, as schools struggle to attract qualified people to take on that challenging role.

On average, teachers earn 76.5 cents on the dollar compared to what college graduates make at other jobs, according to the Economic Policy Institute.

Roza said we lack reliable data on whether out-of-pocket spending has changed over the years. But some teachers can recount times when paying for supplies wasn’t an essential part of their job.

When Wendy Threatt started teaching in California in the late 1990s, the country was enjoying a period of extraordinary prosperity. Unemployment had reached a record low, the economy was growing at a strong pace and inflation wasn’t a concern.

She said the district she worked for had the budget to purchase as many books as she needed and reimbursed her expenses.

“I remember a time in which our administration said, ‘Just give us your receipts and we will pay you back.’ But that was when things in the economy were completely different,” Threatt said.

Soon, that assistance went away. However, she said that thankfully, her district does provide certain resources that others don’t, like copy paper and whiteboard markers.

Meanwhile, Stacey Lindsey from Kansas said she’s consistently purchased supplies for her students with her own money. What has changed, though, is the amount she spends on classroom snacks. It’s a lot more now that the federal government has ended its free lunch program.

Lindsey said schools already have trouble hiring younger teachers, who will inevitably deal with an array of challenges on the job.

“It’s just one more more difficulty for them to face,” she said.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.