“Nickels and dimes” didn’t really interest George Bailey. He was a dreamer who fancied himself an explorer of the world — that is, until circumstances forced him to set aside his travel plans to take over the family business, which provided mortgages to the residents of Bedford Falls.

When his uncle loses $8,000 of the building and loan company’s cash and the future of his business is threatened, Bailey loses all hope until an angel sent by God helps him see the value of his life. This month, Econ Extra Credit is trading documentaries for a feature film. We’ve selected “It’s a Wonderful Life” to collectively watch, a movie that may already be part of your annual holiday rituals. Well known for its heartwarming moments and moral lessons on faith, family and friendship, the film also has its darker elements, its story centered around a man’s contemplation of suicide.

Additionally, the movie is an excellent vehicle for lessons on economics, so much so that economics professors ranked it as their top film to use in the classroom. That’s because the fictional story mirrors the historical realities of the late ‘20s and early ‘30s, a time in American history that economists Milton Friedman and Anna Schwartz dubbed the “The Great Contraction.” Financial institutions failed in waves, including banks and building and loan associations, the type of business run by the fictional Bailey family.

Unlike today, a large portion of banks at the time consisted of single branches. Their fortunes tended to rise and fall with the fortunes of the communities they served, and many were not financially strong enough to weather a bad harvest in a rural area or an economic downturn in a city. When a bank went belly up, depositors stood to lose all their savings because deposit insurance didn’t yet exist. It’s this high level of risk that incentivized people to withdraw their deposits for cash at the earliest signs of insolvency.

The panic was often contagious, and many times the urge to withdraw money was based more on fear than factual evidence of an institution of financial weakness. In either case, an uncontrolled run could lead to bankruptcy of one or several banks.

In one notable scene, we see the residents of Bedford Falls make a run on Bailey Bros. Building & Loan Association. George must try to explain how short-term panic could do lasting damage to the local economy. The scene showed just a fraction of the nationwide panic that occurred in the early 1930s, during which more than 9,000 banks failed. It got so bad that President Franklin Roosevelt declared a six-day bank holiday in March 1933. Americans couldn’t withdraw or transfer any money, while the Federal Reserve, the Roosevelt administration and Congress enacted reforms to stabilize the industry and establish the Fed as an effective guarantor of last resort. There are many other teachable economic moments in the film, so curl up by the fire with a mug of hot cocoa and turn on this holiday classic. More from me and the Econ Extra Credit team next week.

— David

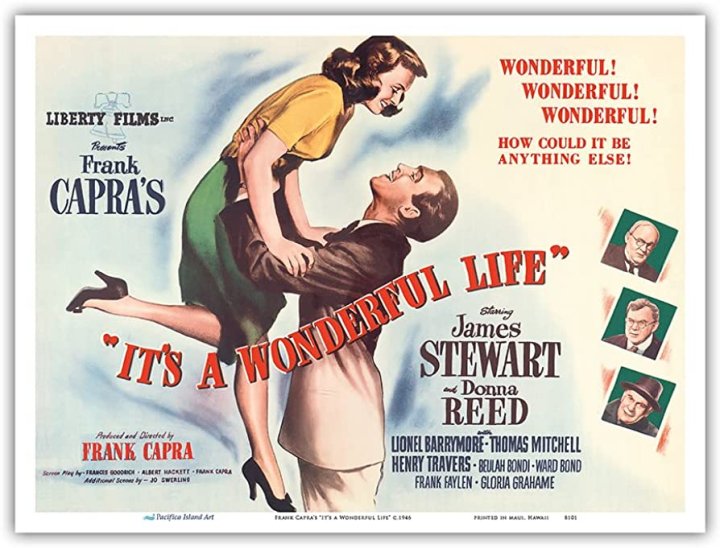

Econ Extra Credit selection for December

Name of Film: “It’s a Wonderful Life”

Year of Release: 1946

Director: Frank Capra

Synopsis: An angel is sent from heaven to help a despairing businessman by showing him what life would have been like if he had never existed.

Where can I watch: “It’s a Wonderful Life” is available to watch with a subscription on Amazon Prime Video, fuboTV, FilmBox and DirectTV Stream. It is also available to rent for a fee on several platforms, including YouTube, Apple TV and Vudu. Some library card holders can stream for free on Hoopla and your local library may also have the film to borrow on DVD or VHS.

Select theaters will also host special screenings of the celebrated film between Dec. 18 and 21.

Themes we‘ll explore:

- The history and demise of building and loan associations

- The differences among national banks, community banks and credit unions

- The purpose banks serve in the economy and society

Is there something you’d like Econ Extra Credit to explore? A question you want answered? Let us know by sending the team an email. We’re at extracredit@marketplace.org.

Check out all our past selected films on our website.

Related Links

We’ll be back next week to unpack more from the film. In the meantime, here are some recommended reads tied to this month’s movie.

- What ‘It’s a Wonderful Life’ teaches us about American history (Smithsonian magazine)

- The morality of banking in “It’s a Wonderful Life” (The Atlantic)

- The 10 greatest films for teaching economics (ResearchGate)

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.