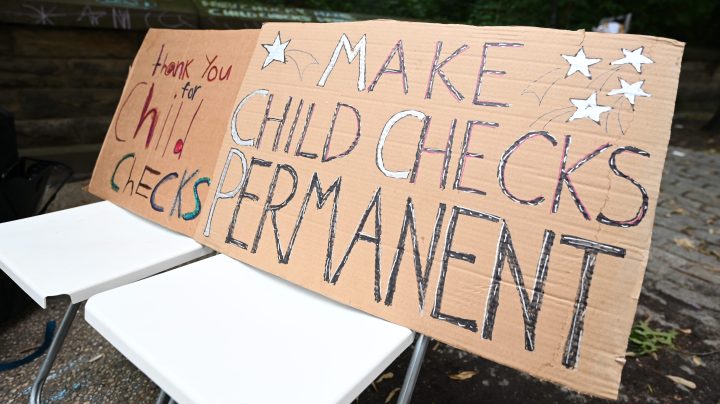

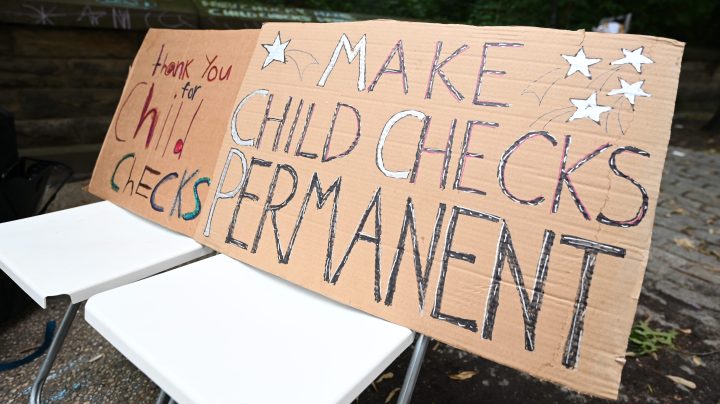

Families begin the new year without child tax credit payments

Families begin the new year without child tax credit payments

Since July, more than 36 million households around the country have received a payment from the federal government on the 15th of the month, up to $300 per kid, from the child tax credit.

But tomorrow, Jan. 15, those payments won’t arrive.

They were part of a one-year expansion of the child tax credit that also increased the amount of the credit and expanded eligibility to the poorest families. So far, Congress has not made any move to extend those changes.

For many low- and middle-income parents, like Jessica Morrison, the monthly payments have been significant.

Before that $550 from the government started arriving reliably in her bank account every month, there were times she had to put groceries on credit.

“Also unexpected expenses, like a car repair, or a plumbing issue, or something around the house that needed to be done,” she said.

Morrison is a caseworker for the state of Pennsylvania, her husband drives for Uber and Lyft, and they have two kids, 2 and 7.

“There have definitely been months on end where we were living paycheck to paycheck, just because of a string of bad luck, where it would take forever for us to get back on our feet,” she said.

The monthly payments from the child tax credit changed that.

“I can honestly say that, like, I haven’t had that feeling of living paycheck to paycheck,” Morrison said. “I’ve definitely felt a lot more sturdy on my feet in terms of our family’s finances.”

It gave them enough wiggle room to be able to cover those unexpected expenses, and for the first time, they also felt they could spare $65 a month to send their 7-year-old daughter to dance classes.

“Which is something that she’s wanted to do for a long time,” Morrison said. “It’s extracurricular, she is able to get exercise, and she’s met new friends. And that’s something that is really just sort of the icing on the cake.”

It’s not a necessity, but seeing all that her daughter is getting out of dance “has been amazing,” she said.

The tax credit has also let Nura Moshtael, a single mother in Atlanta, do things for her son that she wouldn’t otherwise. He’s 13 and has Down syndrome, and “he’s always loved going out to coffee shops and eating out,” she said.

But other needs tend to take up a good chunk of her paycheck.

“My son, because he does have special needs, he gets speech therapy and occupational therapy, and these are extra expenses that we’ve had since he was born,” said Moshtael, who works as a server at a restaurant.

The $250 she’s been getting every month has meant she can budget for the occasional meal out and field trips for her son, whom she’s homeschooling.

There is early evidence that most families have been spending their child tax credit payments much like Moshtael and Morrison: on food, household needs and enrichment for their kids. And it lines up with research about how parents in other countries use child benefits, too, according to Mark Stabile, a professor of economics at the global business school INSEAD.

“They spend more money on education, they spend more money on food at home, they spend more money on transportation, they end up spending less money on alcohol and tobacco,” he said.

There are many countries that give monthly cash payments to parents: Germany, the United Kingdom, Ireland, Sweden, the Netherlands.

“The United States has really been an outlier in terms of not providing this form of regular support for children,” said Megan Curran, director of policy at the Center on Poverty and Social Policy at Columbia University.

“It’s a very common feature of how governments recognize the cost of raising children and also recognize that it benefits society as a whole, to help parents raise children in a healthy and well-supported way.”

According to Curran and other experts, the best place to look for a sense of how an expanded child tax credit might work in the United States longer term is Canada.

“There’re several reasons why Canada is sort of the closest comparison,” said Hilary Hoynes, a professor of economics and public policy at the University of California, Berkeley.

For one, both the amount and structure of Canada’s child benefit are similar to the 2021 child tax credit here.

And two, Hoynes said, the social safety net in Canada — aside from its health care system — is more similar to the social safety net in the U.S. than it is to those in many European countries.

“Many other rich countries that have child benefits also have a lot more access to other sorts of family-based benefits, such as lower-cost child care and preschool, also family leave and other kinds of benefits,” she said.

Even without those, studies show Canada’s poverty rate dropped 20% in two years, after it expanded its child benefit in 2016. And the payments have contributed to what Hoynes calls “a remarkably broad improvement in family outcomes.”

“Kids are more likely to attend school, parents are more likely to report that their children are in better health, parents are more likely to report that the family is able to meet their food needs,” she said.

Other programs in the U.S. that provide financial support to parents, like the earned income tax credit, and SNAP, or food assistance, have had similar effects.

“There’s a very broad set of findings that show that government spending on families with children yields incredible returns to society, relative to the costs of those payments,” Hoynes said.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.