Priceline negotiates reservations

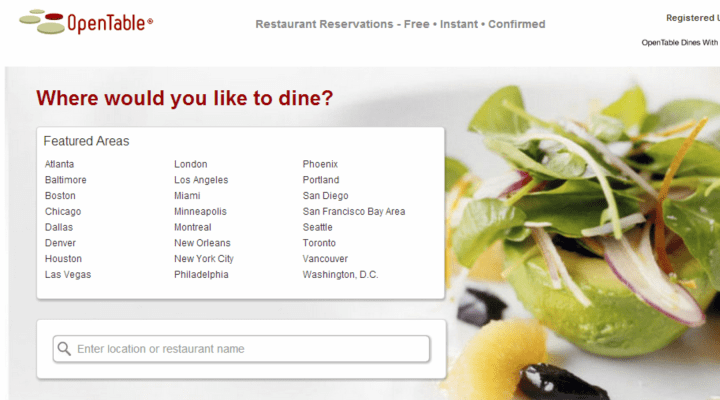

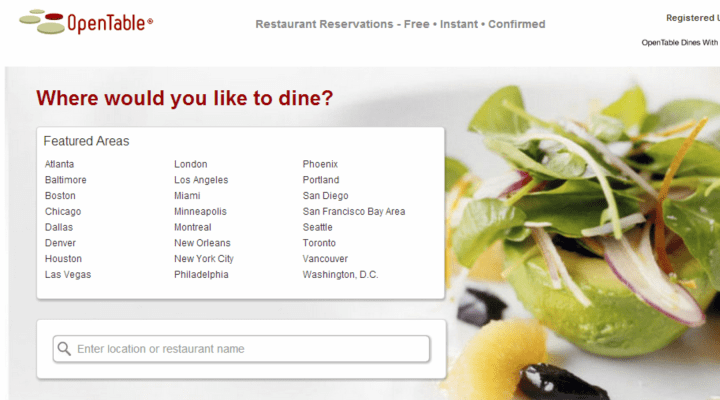

Travel website Priceline just bought OpenTable for $2.6 billion. OpenTable, if you don’t know it, is an online restaurant reservation site. That might sound like kind of an odd move for Priceline, but it’s all about the future of travel… or, actually the past.

Remember travel agents?

You’d go to them before you booked at trip and they’d help you plan your itinerary and be able to give you insider tips, like the cool neighborhood to stay in or a cute bistro you should try. “The travel agent is making a comeback,” says Steve Cohen, Vice President of Research at MMGY Global. Cohen says baby boomers and millennials are gravitating back to travel agents and away from DIY online bookings, because they’re putting convenience and expertise ahead of pure price consideration.

To compete now, says Cohen, travel sites have to be a place where customers can research and plan their entire trip. “A very large percentage of travelers like to have most of their vacation planned before they ever get there,” he says.

Right now on most travel sites, you can book a flight, hotel and rental car, but that’s still missing most of the trip and the money. “As much as 60 percent of a traveler’s budget is spent in their destination,” says Henry Harteveldt, founder of Atmosphere Research Group. “Dining, shopping, entertainment, things like that. The online travel companies are saying, ‘We’ve done a pretty good job tackling that 40 percent, let’s see how much of the rest of the budget we can sink our teeth into.”

And they’re well positioned to do exactly that. Priceline already knows where its customers are going and when. With OpenTable, it will know what they like to eat. “They can start to make recommendations,” says Douglas Quinby, Vice President of Research at PhoCusWright, a travel industry research group. “Well, we see that you like Italian, there’s a fantastic 4-star Italian place that’s got seating available on this night and we know you’re going to be in New York.”

Perhaps most importantly profit-potential-wise, travel sites know where you live during the rest of the year. “It really turns them into this lifestyle utility that also could be used at home,” says Harteveldt. “Something like, here’s a great new store that opened in your city.”

Harteveldt points out we travel, on average, three times per year, but we explore the cities and towns we live in all year.

With Friday’s announced $2.6 billion acquisition of OpenTable, Priceline adds another frontier to its vast booking empire. Priceline Group already owns booking websites kayak.com, booking.com, rentalcars.com, agoda.com, and, of course, priceline.com (well known for its commercials with William Shatner.)

When one company in an industry is purchased by an outsider, it can sometimes lead to interest or inquiry into the potential acquisitions of rivals. Here are some companies who 1) saw their stock prices initially boosted by Priceline’s announced purchase of OpenTable, and 2) also have the financial muscle behind them to snap up some competitors:

Online review sites

Yelp is the 800-pound gorilla of review sites, valued at $4.5 billion since going public last year. But it has competitors like TripAdvisor, Citysearch and Local.com that all perform similar functions, but are not nearly as popular.

Some analysts suggest Yelp should consider buying one of them. Especially since Priceline’s snatching up of OpenTable makes it less likely that Yelp will be acquired by a bigger company. Not that Yelp’s finances were hurt by the news: shares in the company were up.

Coupon and deal sites

Same goes for Groupon, the massive discount coupon site. But Groupon has competition from smaller players like LivingSocial, ScoutMob, Savored and Happy Hours.

Electronic payment services

PayPal also saw an uptick in stock price after the OpenTable acquisition was revealed. The peer-to-peer payment system owned by eBay used to be the only one on the block, but now PayPal has a rival in Square. Smaller competitors like PayDragon, TabbedOut and BarTab are making inroads as well.

Food delivery services

Who you order your food from could be considered as personal as, well, food. A merger of big players already occurred in this business in May 2013, when GrubHub and Seamless announced that they were merging. That company’s stock was initially way up on the news and is a giant among similar services like Delivery.com and Eat24.

[h/t Mashable]

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.