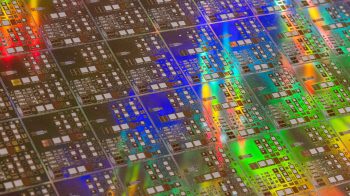

While more secure, Chip and PIN technology is costly

Sam’s Club, the warehouse chain owned by Walmart, is unveiling credit cards with chip-enabled safety technology. In fact, they’re declaring themselves the first mass retailer to do so in the U.S. The cards will be co-branded with MasterCard.

Chip and PIN technology is more secure than the magnetic strip on the back of many cards. Target learned that the hard way when it was hacked last year.

Carl Howe, vice president of research and data sciences at Yankee Group, says the biggest obstacle to adopting chip-enabled technology in the U.S. has been cost, including the price tag for overhauling all those point of sale devices where we swipe our cards now.

“Those are expensive devices — a few thousand dollars each — and they have a lot of them,” he says. “And there’s all the backend programming that’s required for it too. So this is not a small move, it takes a lot of infrastructure to make this work.”

Still, credit card companies want all retailers to follow Sam’s Club’s lead and adopt the technology by late 2015.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.