Explainer: Why dollar cost averaging is stupid smart

Retail investors – you know, people like you and me and the guy next door who day-trades in his PJs – are investing again. In an interview with Fox Business, TD Ameritrade president and CEO Fred Tomczyk described individual investors as “more bullish now than at any time since we started measuring.”

“The retail investor is definitely back, our trades in the first quarter, the March quarter, were up 30 percent year-over-year,” he told Fox Business. “They have been coming in increasingly over the last nine months.”

Tomczyk said the conditions in the market are perfect for retail investors right now.

“They are getting lower trading commissions. They’re getting lower bid ask spreads. They’re getting quicker execution. There is a lot of liquidity in the market,” he said.

But are we keeping it simple?

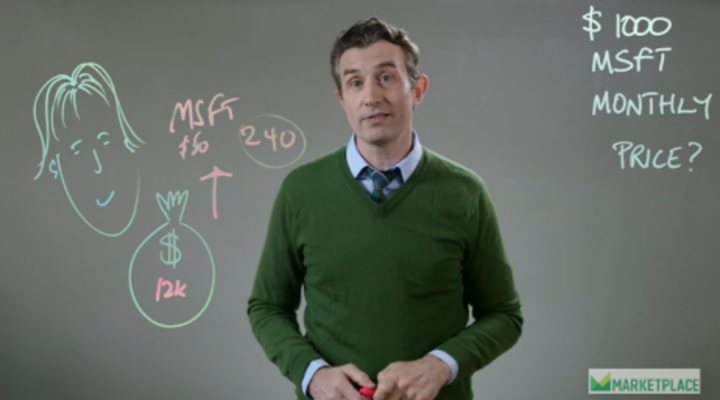

Are we sticking to tried and true investing strategies like using tax advantaged investments, diversification and my personal flavor of the month, dollar-cost averaging?

Maybe. And maybe not.

Tomczyk says we retail investors are using risky strategies like buying on margin, which means borrowing money to make wagers on stocks. That’s the kind of risky behavior that led to the financial crisis, and in an environment when the stock market feels a bit frothy, isn’t going to change the way institutional investors see individuals: as “dumb money.”

Why are we so dumb?

Because we do the opposite of what the pros think they should do. We’re supposedly always late to the game; we supposedly always buy high and sell low; we supposedly always buy stocks when we should be snagging bonds, and pile into bonds when stocks make most sense.

We’re certainly doing the polar opposite of the professionals right now. Banks are increasingly moving out of the trading business, peppered by the twin shotgun barrels of harsh regulation and heavy losses. Trading just isn’t profitable anymore – or at least it’s not as profitable as it was – and the stock market is seen as rigged by high-frequency trading firms. So anyone getting into trading right now must be dumb, right?

Well, hold on there. If you want to be the kind of investor who’s trading in and out of stocks all day long, and trying to compete with the big guys – like that guy in his PJs – then maybe you are at a disadvantage (actually, let’s be honest, there’s no maybe about it – that particular game IS rigged).

But most retail investors aren’t that guy. Most of us are doing things the simple way, in many cases managing our own money because we can’t trust professionals who are increasingly compromised and conflicted by their relationships with the makers of the financial products they shill.

Most of us are using the dead simple, tried and true methods of long-term, diversified investing that really build wealth over time. If that makes us dumb, than I’m happy to be called stupid.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.