Rebates for home builders weighed

Share Now on:

Rebates for home builders weighed

TEXT OF STORY

Renita Jablonski: In the wake of the subprime mortgage meltdown, Congress is considering some tax relief. This one isn’t for homeowners. Instead, it would help home builders through what is, in effect, a tax rebate. Not everyone likes the idea, as Marketplace’s Jeff Tyler reports.

Jeff Tyler: The bill would extend the so-called “net operating loss carry-back rule.” It would allow home builders to apply current losses to tax returns going back four years. By applying those losses to years when business was good, companies could get significant rebates from Uncle Sam. Terry O’Sullivan is general president of the Laborers’ International Union of North America. The union opposes tax relief for corporate home builders.

Terry O’Sullivan: In 2006, they had a $100 billion in revenue, of which they made $16 billion. And two years later, they’re standing in line like pigs at the trough, asking for billions of dollars in a taxpayer handout.

O’Sullivan says the builders are partly to blame for the housing bubble, since many of these companies also made subprime loans. The bill has already passed the Senate. Now it moves to the House.

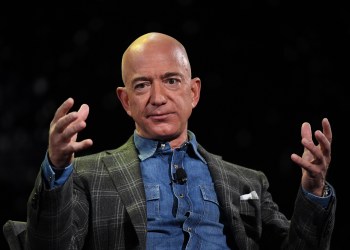

I’m Jeff Tyler for Marketplace.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.