‘The Zero Plan’ targets tax code, budget cuts to slash national debt

‘The Zero Plan’ targets tax code, budget cuts to slash national debt

TEXT OF INTERVIEW

BOB MOON: Balancing the budget is going to be expensive, so who’s going to pay for it?

The bipartisan leaders of the President’s Deficit Commission have put a dramatic plan on the table. It’s saying that cutting $4 trillion worth of government deficits over 10 years. Democrat Erskine Bowles and Republican Alan Simpson envisions big cuts in defense spending, health care and Social Security benefits. For every three dollars of spending cuts, the plan raises another dollar in taxes.

John Dimsdale has been going over the details in Washington. Hey John.

JOHN DIMSDALE: Hello, Bob.

MOON: So what are these two commissioners proposing to do on the tax front?

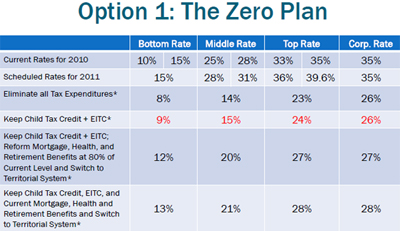

DIMSDALE: Well, their idea is that if you get rid of all the convoluted tax deductions and exclusions and the special treatments for certain favored activities like the mortgage interest deductions or the child tax credit, you expand the number of people who pay taxes and you can bring down overall rates. You can drop middle class tax rates, for example, from 28 to 14 percent and on the wealthy from 35 to 23 percent.

CHART: The proposed “Zero Plan” would reduce the number of tax brackets from five to three, decrease the overall tax rate, and eliminate popular tax deductions such as mortgage interest and capital gains.

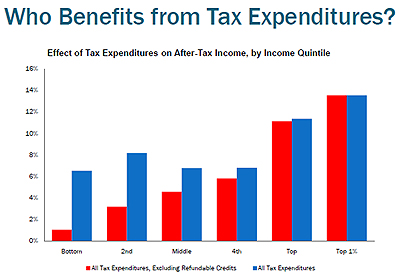

MOON: Under this, would taxes hit different income groups the same as they do now? In other words, would the wealthy bear the progressive share of government revenues compared to the poor and the middle class?

It’s really hard to say. Largely it should be true because the rich are the biggest beneficiaries of these tax breaks that would disappear. They’d lose a lot of advantages. Especially the very wealthy who get a lot of income from capital gains and stock dividends, because under this proposal those would be taxed like regular income. But who wins and who loses almost comes down to individual cases: the size of your mortgage, the size of your family, how much do you spend on health care, how much of your income is from capital gains versus a salary.

You start picking winners and losers and you provoke a lot of opposition. And the problem is, according to Bill Gale at the Tax Policy Center, any real solution has to mean more losers than winners.

CHART: The nation’s top earners would be most affected by changes to the tax code. The blue bar in this chart represents income, and the red bar represents current tax deductions that would disappear under the proposed “Zero Plan.”

BILL GALE: People are comparing the proposal to the status quo and they’re liking the status quo better. The problem is the status quo is not sustainable. This is what a solution looks like and people have to get used to the fact that their taxes are going to go up and their benefits are going to go down.

MOON: Interesting, but I wonder John how realistic are the chances a proposal like this might win approval?

DIMSDALE: Well, it’s been panned from all sides of the political spectrum. But a lot of economists say it’s a serious starting point. This sets a high bar for all future debt reduction ideas. But there’s very little weight behind this. It’s only a draft. It’s not the final commission report, which doesn’t come out until December 1st. And even that won’t be binding on Congress so there’s still a long way to go.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.