Latest Stories

Latest Stories

The TikTok ban is poised to make the U.S.-China divide even starker

by

Kimberly Adams

and Sean McHenry

Apr 23, 2024

"You sort of have these two parallel internets that are existing in both countries," says WSJ technology reporter Meghan Bobrowsky.

Economists used the business cycle to predict what's next. It doesn't work so well anymore.

by

Justin Ho

Apr 23, 2024

Where's the recession? Changes like the pandemic crash and government funding programs have disrupted the expansion-contraction pattern.

The market for small AI

Apr 23, 2024

Some companies may want to work with generative artificial intelligence systems that require less processing power and less cost.

Why does the world want dollars? Because of high interest rates, thriving economy in U.S.

Apr 23, 2024

The greenback is so strong that Japan and South Korea have complained.

Recent college grads see rise in unemployment

Apr 23, 2024

Unemployment jumped from 8.6% to 12.3% among 20-somethings with bachelor's degrees year over year, the BLS reported.

The WIC family food program is getting a refresh, but requirements are still tough to navigate

Apr 23, 2024

The nutrition program is restrictive by design, but updates to the food package are giving parents and kids more options.

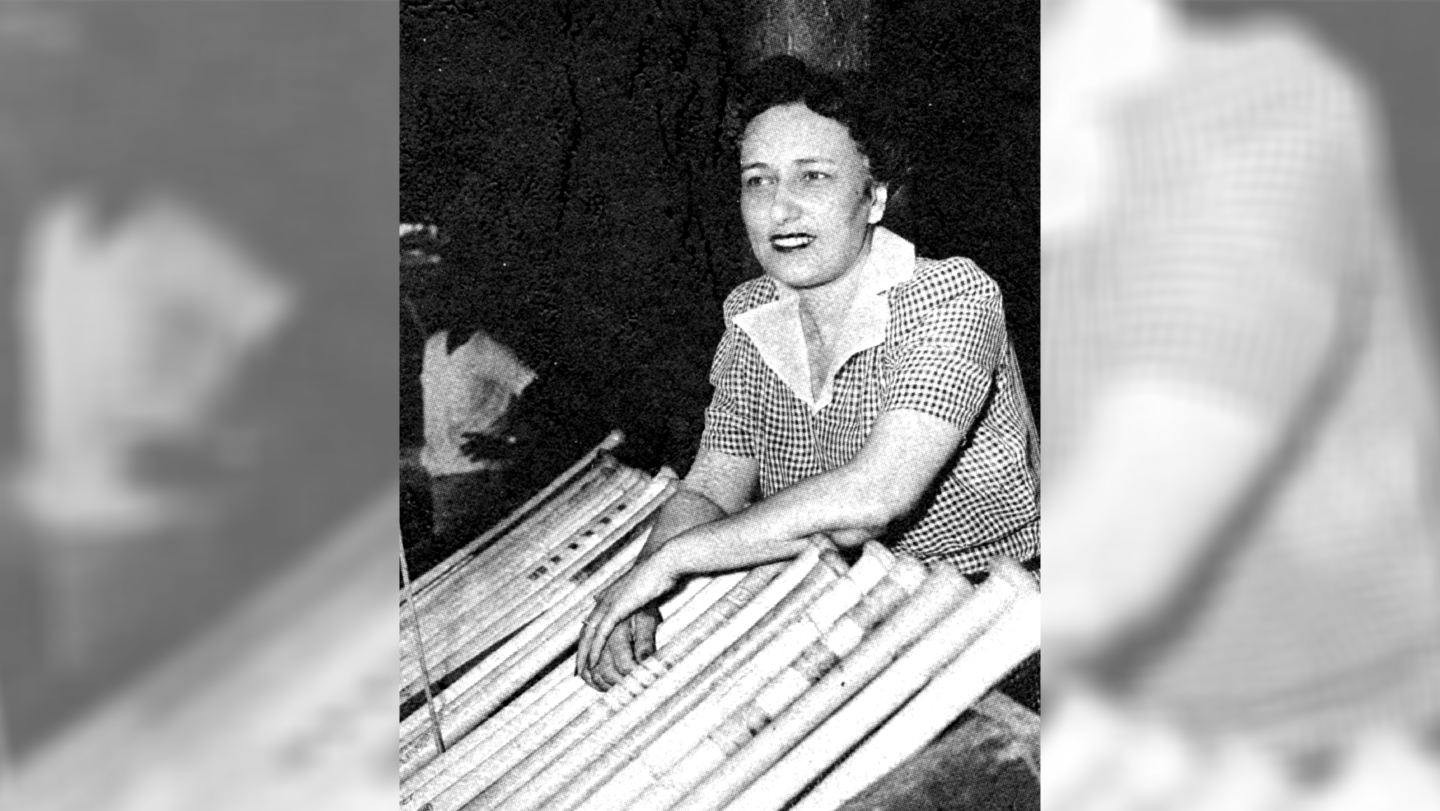

The team owner who fought for civil rights

Apr 23, 2024

Effa Manley, owner of the Newark Eagles, firmly believed her team’s success was tied to the ongoing struggle for justice in her community.

For public good, not for profit.

While El Salvador is turning around its reputation for crime, its economy still struggles

Apr 23, 2024

El Savador's President Nayib Bukele took on gang violence by introducing a state of emergency in 2022. The country is now safer, but its economy is struggling to grow.

What to expect from Tesla ahead of quarterly results

Apr 23, 2024

The company reports after the bell on Tuesday.

Negro Leagues barnstorming brought baseball to new places

by

David Brancaccio

and Alex Schroeder

Apr 23, 2024

It's just one of the lasting economic legacies of the professional baseball played in the Negro Leagues in the 20th century.

!["This is the first sign of [the job market] not being as strong as I thought it was," said Patricia Anderson with Dartmouth.](https://www.marketplace.org/wp-content/uploads/2024/04/GettyImages-157180551.jpg?w=960)